This blog seeks to unravel the intricacies of the promotion structure within Public Sector Banks, providing an in-depth exploration into the career progression of both Probationary Officers and clerks. Recognizing the importance of understanding the trajectory of advancement within these key banking roles, the content serves as a compass for aspirants navigating their careers strategically. By delving into the various avenues of growth and development, readers will glean valuable insights into the hierarchical steps, evolving responsibilities, and diverse opportunities awaiting those who become a Bank PO. The comprehensive examination of the promotion structure is designed to equip individuals with the knowledge necessary to chart their professional ascent amidst the dynamic landscape of Public Sector Banks.

This blog essentially empowers readers with a holistic understanding of the multifaceted dimensions that define a Bank PO’s career journey. From the initial aspirations of securing a prestigious position to the nuanced strategies required for sustained growth, the exploration aims to be a valuable resource for individuals navigating the evolving terrain of banking careers.

Promotion Structure in Banks

For several reasons, a bank job through the IBPS recruitment process is considered secure and beneficial. Firstly, banks are integral to the economic system, providing stability and longevity for employment. Job security is further reinforced by the stringent selection process of IBPS exams, ensuring that only qualified and competent individuals secure positions. Additionally, bank jobs offer attractive salary packages, various allowances, and opportunities for career advancement.

Furthermore, the comprehensive benefits packages, including health insurance, retirement plans, and other perks, contribute to the overall well-being of employees. Banks prioritize skill development, providing continuous training and learning opportunities, and enhancing the employability of individuals. The structured career progression and diverse job roles within the banking sector enable employees to carve out a long-term and fulfilling career path. Overall, a bank job secured through IBPS provides financial stability and paves the way for professional growth, making it a coveted and advantageous choice for job aspirants.

- Career Progression and Stability: Entering the banking industry through IBPS ensures a structured career path, starting with a probationary period of two years. Successful completion guarantees job security and opens doors to regular promotions, providing a sense of stability and long-term career prospects.

- Dynamic Job Roles and Designations: The banking sector offers diverse job profiles and designations. Through promotions, employees experience a continuous evolution in their roles, breaking monotony and keeping the work environment engaging and intellectually stimulating.

- Geographical Exposure and Exploration: Employees can explore different locations across India post-promotion. Banking jobs often involve transfers, allowing individuals to gain exposure to diverse cultures and work environments, and fostering personal and professional growth.

- Attractive Perks and Benefits: The banking industry rewards employees with various perks and benefits, including competitive salary packages, health insurance, retirement plans, and more. These incentives contribute to the overall well-being of individuals and enhance the attractiveness of a banking career secured through IBPS.

Promotion Structure in Public Sector Banks

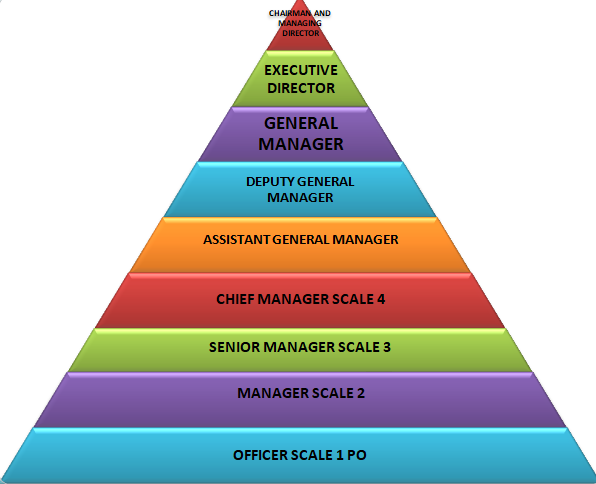

In India, Public Sector Banks (PSBs) implement a meticulously structured promotion hierarchy designed to foster the career progression and professional development of their Probationary Officers (POs). Commencing at the entry-level Scale I position, this hierarchical system serves as a comprehensive roadmap for aspirants within the dynamic banking sector. The journey unfolds with individuals undertaking the role of POs, undergoing rigorous training and evaluation during a probationary period.

As they successfully navigate this initial phase, employees ascend through various managerial grades, such as Junior Managers in Scale II, Chief Managers in Scale III, and Assistant General Managers in Scale IV. This progression culminates in top-tier executive roles, including Deputy General Manager (Scale V), General Manager (Scale VI), and ultimately, leadership positions like Executive Director (ED) and Chairman and Managing Director (CMD). Understanding and navigating this hierarchy is pivotal for aspirants, as it not only ensures job security, but also provides a clear and structured pathway for advancement in the ever-evolving landscape of the banking industry. Let’s take a look at the promotional structure in Public Sector Banks in detail below. You can understand this even better through the table given after this:

- Scale I – Probationary Officer (PO): Aspiring bankers begin their career journey at Scale I as Probationary Officers. This entry-level position in Public Sector Banks (PSBs) involves an immersive training program and a probationary period during which recruits undergo rigorous evaluation. The training program exposes POs to various facets of banking operations, honing their skills and preparing them for higher responsibilities.

- Scale II – Manager: Successful completion of the probationary period propels individuals to Scale II, where they assume managerial roles as Junior Managers. Responsibilities expand to include overseeing specific banking functions, managing teams, and contributing to the efficient functioning of the bank at the operational level.

- Scale III – Chief Manager: Progressing to Scale III, employees achieve the designation of Chief Manager. This middle management role signifies a substantial increase in responsibilities and decision-making authority. Chief Managers are crucial in formulating and implementing strategic initiatives within their respective domains.

- Scale IV – Assistant General Manager: Scale IV marks the transition to the Senior Management Grade, with individuals assuming the role of Assistant General Managers. In this capacity, they hold key positions overseeing diverse banking operations, contributing to policy formulation, and ensuring the effective execution of strategic objectives.

- Scale V – Deputy General Manager: Progressing further up the hierarchy, Scale V designates individuals as Deputy General Managers. At this senior management level, they contribute significantly to the bank’s strategic planning and execution, playing pivotal roles in decision-making processes that impact the overall direction of the institution.

- Scale VI – General Manager: Scale VI represents the top tier of the Middle Management Grade, where professionals ascend to the role of General Managers. In this capacity, they lead and direct the bank’s critical functions, providing strategic direction and contributing to the organization’s overall success.

| Hierarchy | Scale | Grade |

| PO | Scale I | Junior Management Grade |

| Manager | Scale II | Middle Management Grade |

| Senior Manager | Scale III | Middle Management Grade |

| Chief Manager | Scale IV | Senior Management Grade |

| Assistant General Manager | Scale V | Senior management Grade |

| Deputy General Manager | Scale VI | Top Management Grade |

| General Manager | Scale VII | Top Management Grade |

| Executive Director (ED) | – | – |

| Chairman and Managing Director (CMD) | – | – |

Bank Promotion Structure in JAIIB and CAIIB

Once you successfully navigate all stages of the bank PO examination, securing the position of Probationary Officer (PO) or Assistant Manager, a transformative journey unfolds in your banking career. Banks designate the initial two years as a probationary period, during which you undergo intensive training and evaluation. Upon successful completion, you attain permanent status in the job, marking a significant milestone in your professional trajectory.

To propel your career forward, banking institutions encourage further education through the Junior Associate of Indian Institute of Banking (JAIIB) and the Certified Associate of Indian Institute of Banking (CAIIB). Offered by the Indian Institute of Banking and Finance (IIBF), these courses are integral for career advancement. As a diligent banker, you embark on the JAIIB course, followed by the more advanced CAIIB upon completion.

These courses not only enhance your knowledge and skills, but also add substantial value to your professional profile. Successful qualification in JAIIB and CAIIB opens avenues for increments and promotions, aligning your career trajectory with the evolving demands of the banking sector. By investing in continuous learning, you not only stay abreast of industry developments but also position yourself for higher responsibilities and increased remuneration, making these courses a vital component in the growth process of a bank PO.

Promotion Structure in Banking: Certifications, Achievements, and Soft Skills

Navigating a successful banking career involves understanding the intricacies of the promotion structure. This journey encompasses certifications, achievements, and the development of soft skills, each playing a crucial role in advancing professionals through the ranks.

- JAIIB Course: Building Fundamental Banking Knowledge: The JAIIB course serves as a foundational pillar for banking professionals, imparting essential knowledge about the intricacies of the banking industry. Covering key tasks and functions equips candidates with a comprehensive understanding of their roles. The course is undertaken immediately after joining, providing a strong knowledge base that lays the groundwork for a successful banking career.

- CAIIB Course: Specialized Advancement and Increment Opportunities: CAIIB represents a specialized course where candidates attempt three papers and one elective. Conducted online twice a year, successful completion adds depth to a banker’s expertise and provides avenues for career advancement, promotions, and additional increments. It becomes a valuable asset throughout one’s professional journey, contributing significantly to lifetime earnings.

- Online and Biannual Exams: Continuous Learning Opportunities: JAIIB and CAIIB exams are conducted online twice yearly, offering banking professionals consistent learning and skill enhancement opportunities. This format ensures that individuals stay updated with industry trends, contributing to their proficiency and adaptability in the dynamic banking landscape.

- Strategic Career Advancement Through CAIIB: Depending on the availability of vacancies, qualifying CAIIB provides a strategic advantage in promotions, enriching interview responses, and positioning candidates favorably against their peers who have not obtained this specialized certification. It becomes a distinguishing factor in career progression within the banking sector.

- Overachieving Targets: Leveraging Opportunities as a PO: Post-JAIIB and CAIIB, Probationary Officers have the opportunity to work closely with Branch Managers, engaging in diverse tasks such as account opening, lending, cross-sales, and NPA recovery. Proactively learning and overachieving targets during this phase showcases dedication and positions individuals for accelerated career growth.

- Soft Skills and Time Management: Nurturing Interpersonal Skills: Soft skills, including communication, management, and interpersonal abilities, play a pivotal role in a bank professional’s success. Working alongside colleagues of varying ages, POs gradually develop effective communication and people management skills, enhancing their ability to collaborate and navigate diverse professional environments.

The combination of foundational knowledge from JAIIB, specialized expertise from CAIIB, continuous learning opportunities, strategic career planning, overachievement of targets, and the development of soft skills collectively contribute to a comprehensive growth strategy for individuals pursuing a fulfilling career in the banking sector.

About IBPS PO Promotion

Embarking on a career as an IBPS Probationary Officer (PO) opens doors to a dynamic role, with multifaceted responsibilities crucial for the seamless operation of a Bank/Branch office. This journey involves key tasks, including the processing of loans, supervision of Bank Clerks in clerical tasks, and ensuring the overall smooth functioning of the office. Interacting with clients and customers is also a pivotal aspect of the IBPS PO’s role, highlighting the importance of interpersonal skills.

For a comprehensive understanding of the IBPS PO role, individuals can benefit from ixamBee’s IBPS PO Online Course, designed to provide in-depth insights into the intricacies of the job, promotion opportunities, and salary structures. This course serves as a valuable resource for those aspiring to excel in the competitive realm of IBPS PO positions.

IBPS PO Salary Structure

The core of the IBPS PO salary structure is the ₹36,000 monthly basic salary, serving as the benchmark for their overall remuneration. This foundational element ensures a stable and competitive starting point for individuals entering the banking profession.

- Allowances Enhancing Compensation: IBPS POs benefit from a suite of allowances, including City Compensatory Allowance, Dearness Allowance, House Rent Allowance, and Special Allowance. These additional components significantly enhance their total compensation, addressing various aspects of living and working conditions.

- Retroactive Components: The inclusion of Retro CCA and Retro HRA in the compensation structure reflects a commitment to maintaining financial parity over time. These retroactive components ensure that past adjustments are considered, providing consistency and fairness in remuneration.

- Comprehensive Pay Structure: The Gross Pay, which encompasses the basic salary and various allowances, offers a comprehensive view of the total compensation received by IBPS POs. This holistic approach provides transparency and clarity regarding the overall financial package associated with the role.

- Net Pay after Deductions: Net Pay is the final amount IBPS POs receive after necessary deductions. This includes adjustments for taxes and other deductions, offering a practical perspective on the take-home earnings that individuals can expect in their banking career.

- Holistic Compensation Package: Amalgamating a competitive basic salary, diverse allowances, and retroactive components creates a holistic compensation package for IBPS POs. This comprehensive approach fosters financial stability and enhances job satisfaction, making the banking profession an attractive and rewarding career choice.

SBI PO Career Growth and Promotion

SBI structures and progressively develops the careers of its Probationary Officers (POs). Beginning at the Junior Management Grade (Scale 1), POs ascend through middle and senior management roles, reaching the top tier as General Managers. The pinnacle is the Chief General Manager, followed by executive leadership roles in Scale 8, such as Deputy Managing Director, Managing Director, and Chairman. ixamBee’s SBI PO Online course provides comprehensive and targeted preparation for aspiring candidates, equipping them with the knowledge and skills needed to excel in the competitive SBI PO exam. The SBI PO Salary, inclusive of basic pay of ₹41,960 along with various allowances and benefits, makes it an attractive career choice, offering financial stability and growth opportunities in one of India’s leading banking institutions. This hierarchical progression reflects career advancement and highlights the bank’s commitment to nurturing leadership and expertise within its ranks. A basic idea of the structure is given below.

- Junior Management Grade Officer (Scale 1): Initiating the SBI PO career, individuals begin as Junior Management Grade Officers in Scale 1, marking the entry point into the hierarchical progression.

- Middle Management Grade (Scale 2 and 3): Advancing from PO, the journey extends to Scale 2 as Managers and further to Scale 3 as Senior Managers, signifying the evolution into middle management roles with increased responsibilities.

- Senior Management Grade (Scale 4 and 5): Progressing to Scale 4 as Chief Managers and Scale 5 as Assistant General Managers, professionals enter senior management, overseeing critical organizational functions.

- Top Management Grade (Scale 6 and 7): The top tier beckons with Scale 6 as Deputy General Managers and Scale 7 as General Managers, assuming strategic leadership roles in the bank.

- Chief General Manager (CGM): Achieving the pinnacle of the SBI hierarchy, individuals reach the prestigious position of Chief General Manager, symbolizing extensive experience and leadership within the organization.

- Executive Leadership Roles (Scale 8): The highest echelons encompass Scale 8 roles, comprising Deputy Managing Director (DMD) and Managing Director (MD), and culminating in the esteemed position of Chairman, showcasing executive leadership at its zenith.

Take a look at the SBI PO career progression scale in the table below.

| Post | Scale |

| Junior Management Grade Officer i.e. PO (you start here) | Scale 1 |

| Middle Management Grade i.e Manager | Scale 2 |

| Middle Management Grade i.e Senior Manager | Scale 3 |

| Senior Management Grade i.e Chief Manager | Scale 4 |

| Senior Management Grade i.e Assistant General Manager | Scale 5 |

| Top Management Grade i.e Deputy General Manager | Scale 6 |

| Top Management Grade i.e General Manager | Scale 7 |

| Chief General Manager (CGM)Deputy Managing Director (DMD)Managing Director (MD)Chairman | Scale 8 |

Prepping with ixambee

ixamBee provides a strategic and effective approach to competitive exams and offers various online courses, free mock tests, previous year papers, and expert guidance. Tailored study resources for various banking and government exams ensure comprehensive preparation. The user-friendly interface and personalized learning plans make ixamBee an ideal choice for candidates seeking to enhance their skills and boost success in exams. The platform’s commitment to quality content and innovative learning tools fosters a conducive environment for aspirants to excel in their exam preparations and confidently face the challenges of competitive assessments.

Summing Up

Embarking on a career in banking through IBPS or SBI offers a structured path to success. The intricate promotion structures, certification avenues, and soft skills development create a comprehensive growth strategy. Recognizing the dynamic landscape, ixamBee is a crucial ally in exam preparation. Ultimately, a bank job secured through IBPS or SBI promises financial stability and a fulfilling journey with continuous learning, diverse opportunities, and the pride of contributing to the nation’s economic backbone.

Preparing for the IBPS PO Exam? Ace your preparation with ixamBee’s IBPS RRB PO & Clerk online course, designed by experts to help you succeed. Boost your confidence with our IBPS PO Mains mock tests, practice with IBPS PO Mains PYP, and get structured guidance with our Target Banking Online Course. Enroll now and take a step closer to your dream banking career with ixamBee’s top-notch resources! 🚀

At ixamBee, we specialize in providing comprehensive online courses for government exams and online courses for government jobs. Our expertly designed courses for government jobs cater to a wide range of upcoming government exams. Whether you’re preparing for specific courses for government exams or seeking general guidance, ixamBee offers the resources like Beepedia previous year papers, SSC CGL, SSC CHSL, SSC MTS and other mock tests to succeed in exams like RBI Grade B, SEBI Grade A, NABARD Grade A, RRB NTPC, SSC MTS, NIACL Assistant, and more.

Also Read:

RBI Success Story: Perth Sierra Shares His Strategy to Clear RBI Grade B

RBI Success Story: Mandar Shares his Sure Fire Formula for RBI Grade B Success

RBI Grade B Success Story: Amit Kumar’s Strategy to Success in Three Months

конга займзайм экспрессонлайн займ на карту