It is worth noting that when SEBI wasn’t in existence, we still used to have a large capital market and trading of securities on stock exchanges. In fact, BSE (formerly known as Bombay Stock Exchange Ltd.) is Asia’s oldest stock exchange established in 1875.

So, what was the need to establish SEBI in 1992, and who were the bodies performing SEBI’s functions prior to its existence?

Establishment of SEBI

Before SEBI, the Controller of Capital Issues was the regulatory authority; it derived authority from the Capital Issues (Control) Act, 1947. Actually, SEBI (Securities and Exchange Board of India) was first established in 1988 as a non-statutory body. It became an autonomous body on 12 April 1992 and was accorded statutory powers under the SEBI Act 1992.

During the time of economic reforms in India, there was fast growth and increasing importance of the securities market. Thus, SEBI was created as an independent, autonomous body.

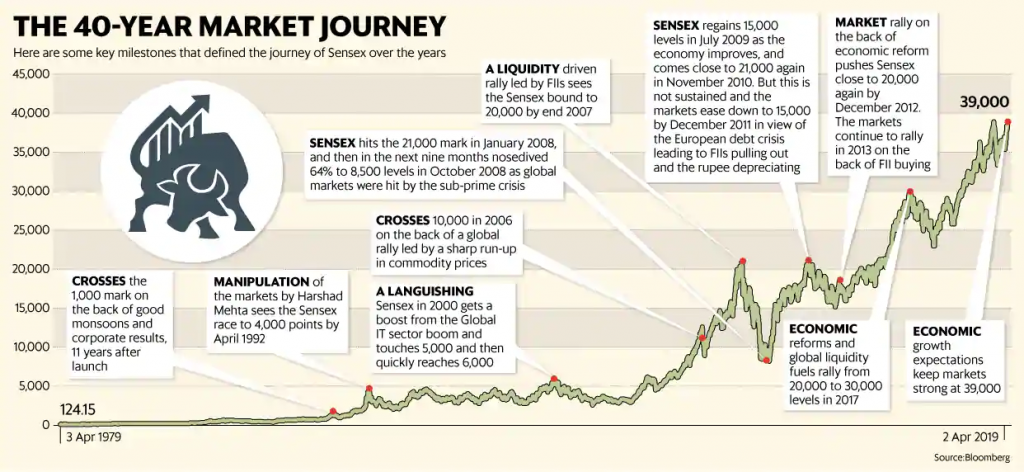

To understand the things stated a little better, have a look at the journey of SENSEX in the past 40 years.

SEBI and Its Significance on Common Public

The journey is going to be much more exciting in the coming years. In India, about 2.5% of the adult population participates in the share market, while in the USA, this is 55%. With the increase in financial literacy, more people are participating in the securities market in India, and more businesses are interested in raising money from the public. This makes working with SEBI an exciting opportunity.

Functions of SEBI

- Regulation of Stock Exchanges: SEBI oversees and regulates stock exchanges to ensure fair and transparent trading practices.

- Investor Protection: The board implements measures to safeguard the interests of investors, preventing fraudulent activities and promoting confidence in the markets.

- Policy Formulation: SEBI formulates policies that govern the securities market, contributing to its stability and fostering growth.

- Educating Investors: SEBI plays a crucial role in investor education, raising awareness and providing information to empower investors in making informed decisions.

- Grievance Redressal: The board provides a platform for addressing grievances, ensuring that disputes are resolved in a fair and timely manner.

- Continuous Monitoring: SEBI engages in continuous monitoring of market activities and enforces regulations to maintain the integrity of the securities market.

- Promoting Awareness: Apart from education, SEBI actively works to promote awareness about the securities market and investment opportunities.

- Building a Trustworthy Environment: Through its multifaceted functions, SEBI aims to create a robust and ethical financial ecosystem, building trust among stakeholders.

Hierarchy Structure of SEBI

The Securities and Exchange Board of India (SEBI) has different levels of officers, each with specific roles and responsibilities. The officer cadre at SEBI includes:

Grade A Officers:

These are entry-level officers who play a crucial role in the regulation and supervision of the securities market. They undergo rigorous training and are involved in various functions such as policy formulation, market surveillance, and enforcement.

Grade B Officers:

This level represents officers with a higher level of experience and expertise. They may have supervisory roles, overseeing specific departments or functions within SEBI. Grade B Officers are involved in policy implementation and may lead teams in areas like market intermediaries, legal, or inspection.

Grade C Officers:

At this level, officers typically hold managerial positions, responsible for significant departments or functions within SEBI. They contribute to strategic decision-making, policy development, and overall organizational management.

Executive Directors and Chief General Managers:

These officers are at senior management levels and are responsible for critical functions within SEBI. They often play a key role in shaping policies, making strategic decisions, and ensuring effective regulation of the securities market.

Whole-Time Members and Chairman:

The highest levels in SEBI’s hierarchy include Whole-Time Members and the Chairman. These individuals provide leadership and direction to the organization. The Chairman, in particular, is the head of SEBI and plays a pivotal role in policy formulation and decision-making.

The hierarchical structure allows SEBI to effectively carry out its mandate of regulating and developing the securities market in India.

Every year SEBI announces vacancies for Grade A level officers in various streams, including Legal, IT, and more. SEBI Grade A is a great opportunity to start your career in a prestigious organization like SEBI. Before heading to making a career, it is important to have an overview of the profile. Therefore, lets delve into a brief introduction of the SEBI Grade A officer.

SEBI Grade A Officer: An Introduction

The SEBI Grade A Officer is a distinguished position within the Securities and Exchange Board of India (SEBI). These officers play a pivotal role in regulating and supervising the securities market in India. Entrusted with maintaining market integrity and investor protection, they ensure that financial markets operate smoothly. SEBI Grade A Officers undergo rigorous training to acquire the necessary skills for effective market oversight. Their responsibilities include formulating policies, conducting inspections, and enforcing regulations to foster a transparent and fair securities environment. The role demands a deep understanding of financial markets and a commitment to upholding the highest standards of professionalism. SEBI Grade A Officers contribute significantly to the stability and development of India’s financial landscape.

The SEBI Grade A Notification, Its Importance and Competition

Working with SEBI as a SEBI Grade A Officer benefits in giving an excellent salary with numerous perks and allowances. This is the reason that for every vacancy at SEBI, it receives 100X applications. This makes the SEBI Grade A Notification a desirable opportunity to grab among aspirants. The competition is quite high for Grade A Profiles. With years of research and with experience of successful candidates we have observed that candidates of every background clear this exam.

The notification release of the SEBI Grade A becomes important due to the lucrative career opportunity it comes with. A handsome salary and, of course, job security. Thus, students never want to miss this. Every year, millions of students appear for this exam, making it a high-level competition among students. If you are someone looking to establish a career at SEBI, we recommend you to always keep an eye on credible resources on the internet, like the official website of SEBI and many more, to stay updated with any information regarding SEBI Notification release dates and other probabilities.

Preparation for the SEBI Grade A Exam

In competitive exams like the SEBI Grade A Exam, the nervousness is at its peak. As a result, students end up performing drastically in the actual exam daty. Thus, a strategic preparation strategy is needed to not only complete the SEBI Grade A syllabus but also cope with exam stress and pre-exam anxiety. SEBI Grade A Mock Tests and Previous year papers are one of the ice-breaking resources that will help you throughout your preparation process. From making you familiar with the Exam Pattern to enhancing your performance on the exam day, these resources will always have your back. However, there are some common things regarding preparation strategy and study material that are not known by everyone.

Expert guidance has always been a cherry on the cake in the preparation process of any exam. Thus, ixamBee provides an exclusive SEBI Grade A Online Course that has been designed keeping the latest exam pattern and syllabus in detail. Here, you will get customized guidance from industry experts and experienced mentors.

Conclusion

The SEBI Grade A exam opens doors to a rewarding career in regulating India’s financial markets. The establishment of SEBI in 1992 marked a crucial step towards ensuring fair and transparent trading. With its multifaceted functions and robust hierarchy, SEBI plays a vital role in investor protection, policy formulation, and market stability. The SEBI Grade A officer position offers a prestigious role in this framework. Aspirants are encouraged to stay updated on SEBI notifications, prepare strategically, and consider the expert guidance provided by resources like ixamBee. Seize the opportunity to contribute to India’s financial landscape by applying for the SEBI Grade A exam in the upcoming months.