The Reserve Bank of India (RBI), as the nation’s central banking authority, plays a pivotal role in managing currency circulation. Its responsibilities extend beyond printing banknotes, encompassing an intricate web of monetary policy tools. These tools, including the Cash Reserve Ratio, Statutory Liquidity Ratio, repo and reverse repo rates, and the bank rate, are integral to India’s financial stability and economic growth.

Within this framework, the Department of Currency Management assumes a critical role. This department is entrusted with the core function of administering currency management following the Reserve Bank of India Act 1934. Currency management primarily involves the issuance of notes and coins, as well as the retrieval of unfit currency from circulation. This vital work is conducted through a network of 18 issue offices of the Reserve Bank, complemented by an extensive infrastructure of 4195 currency chests, 488 repositories, and 3562 small coin depots managed by various banks and Government treasuries. The synergy of these efforts ensures the smooth functioning of India’s currency circulation, safeguarding the nation’s economic stability.

RBI’s Role in Currency Management

The Reserve Bank of India (RBI) manages the nation’s currency supply. Each year, RBI carefully determines the volume and value of banknotes to be printed. This decision is influenced by various factors, including the need to meet the demand for banknotes driven by inflation, GDP growth, replacing old banknotes, and reserve stock requirements. To ensure a smooth flow of currency within the nation, RBI relies on a network of printing presses and mints strategically situated across India. Here’s a closer look at these crucial facilities.

- Security Printing and Minting Corporation of India Limited (SPMCIL): The Security Printing and Minting Corporation of India Limited (SPMCIL) operates currency presses at Nasik in Western India and Dewas in Central India. These presses play a pivotal role in printing and ensuring the quality of banknotes, contributing to the seamless circulation of currency in these regions.

- Bharatiya Reserve Bank Note Mudran Private Limited (BRBNMPL): The Bharatiya Reserve Bank Note Mudran Private Limited ( BRBNMPL) is what the Indian Mint is known as. The Mint manages two currency presses, one in Mysuru, Karnataka(Southern India), and the other in Salboni, West Bengal (Eastern India). These presses are integral to the production of banknotes, further supporting the currency supply system in the respective regions.

- Coin Minting by SPMCIL: You should know that the SPMCIL also oversees the minting of coins at four locations. These locations are some of the major cities in India, namely Mumbai, Hyderabad, Kolkata, and Noida. These mints play a crucial role in ensuring a steady supply of coins for transactions across the nation, contributing to the efficiency of India’s currency ecosystem.

RBI Currency Departments

The RBI’s Issue Department holds a crucial role in the creation and circulation of currency notes in India. Its responsibilities include safeguarding the currency notes in circulation and maintaining the necessary reserves for issuing them. In compliance with the Reserve Bank of India Act 1934, the Department of Currency Management administers the RBI’s currency management functions. These functions encompass gold and foreign currency reserves that are utilized in the issuance of currency notes. As part of the minimum reserve system established in 1956, the RBI must maintain a minimum reserve of Rs 200 crore, with Rs 115 crore as gold coins or bullion. This reserve serves as a demonstration of confidence when printing currency and does not directly correlate with the face value of the issued currency.

Notably, the Issue Department can issue currency notes only in exchange for other denominations of notes or against specified assets, including foreign exchange and gold. This stringent control ensures the stability and reliability of the currency supply in India.

Department of Currency Management

The Department of Currency Management is entrusted with overseeing and executing pivotal currency management functions by the Reserve Bank of India Act 1934. These functions encompass not only the issuance of currency notes and coins but also the essential task of removing unfit or deteriorated notes from the circulation system, thereby maintaining the integrity of the currency supply.

To fulfill these responsibilities effectively, the Reserve Bank operates a network of 18 strategically located issue offices nationwide. Moreover, this extensive currency management system is fortified by a vast network of 4195 currency chests, 488 repositories, and 3562 small coin depots, expertly supervised by banks and government treasuries. This concerted effort ensures that the public has access to a consistent and reliable supply of currency notes and coins, which is vital for the smooth functioning of India’s financial transactions and monetary system.

Organizational Structure of Currency Management Department

The Currency Management Department (DCM) operates under the oversight of a Chief General Manager, who provides crucial leadership to this department. Within DCM, several specialized divisions work collaboratively to ensure efficient currency management. These include a planning division, treasury division, note processing and data analysis division, note exchange division, currency chest division, security and discipline cell, inspection follow-up division, coordination and development division, staff cell, administrative division, forged note vigilance cell, and a museum cell.

The Department receives a steady supply of currency notes from four printing presses. These include two currency note printing presses owned by the Government of India, strategically located in Nasik (Western India) and Dewas (Central India). Additionally, the Reserve Bank possesses two printing presses through its wholly-owned subsidiary, Bharatiya Reserve Bank Note Mudran Ltd. (BRBNML), situated in Mysore (Southern India) and Salboni (Eastern India), collectively contributing to the efficient production of currency notes.

Notably, coin production is carried out in four government-owned mints, each vital in minting coins for various denominations. These mints are situated in prominent locations, namely Mumbai, Hyderabad, Calcutta, and Noida, collectively contributing to the smooth functioning of India’s currency supply system.

Also Read: RBI Full Form with Details

Functions of the Currency Management Department

The Currency Management Department has responsibilities ranging from designing secure banknotes to predicting and fulfilling currency demand, and it ensures the efficient circulation of currency across the nation. Maintaining currency integrity, enforcing RBI (Note Refund) Rules, enhancing work procedures, and disseminating vital information are among its core functions. Aspiring candidates looking to join this department can avail themselves of online courses by ixamBee, which offer comprehensive preparation for RBI Recruitment Exams. Let’s take a look at the functions of the RBI below:

- Banknote Design and Quality Assurance: The Currency Management Department shoulders the critical responsibility of overseeing the design and quality of banknotes. Collaborating with the government ensures that currency notes have robust security features, which is essential to deter counterfeit attempts and maintain the public’s trust in the currency.

- Predicting and Meeting Currency Demand: Anticipating the demand for banknotes and coins is a pivotal task that the Department undertakes. It employs meticulous forecasting techniques, considering economic growth, inflation, and consumer behavior to ensure an optimal currency supply, thus supporting the nation’s financial transactions effectively.

- Efficient Distribution and Currency Circulation: Ensuring the smooth distribution of banknotes and coins across the country is another crucial function. This encompasses delivering fit currency to banks, currency chests, and small coin depots while removing unfit notes and outdated coins from circulation. This process is essential for maintaining a reliable and efficient currency supply system.

- Ensuring Currency Integrity: The Department prioritizes preserving currency integrity, ensuring that every banknote in circulation meets the required standards. This encompasses maintaining the quality of the notes in use, safeguarding against counterfeit currency, and efficiently retiring deteriorated notes.

- Implementation of RBI (Note Refund) Rules: The Currency Management Department enforces the RBI (Note Refund) Rules, 2009, outlining the procedures for exchanging and refunding damaged or mutilated currency notes. This function ensures a systematic process for addressing issues related to unfit or damaged banknotes.

- Ongoing Enhancement of Work Procedures: A continuous review and rationalization of work systems and procedures at issue offices is essential to enhance efficiency and accuracy. This ongoing evaluation helps streamline processes and keep the currency supply system responsive to evolving needs.

- Dissemination of Currency-Related Information: The Department plays a pivotal role in disseminating essential information to the general public regarding currency-related matters, including security features, counterfeit detection, and guidelines for exchanging damaged or mutilated notes. This helps enhance public awareness and trust in the currency.

- Maintaining Currency Production Infrastructure: A fundamental task is overseeing and maintaining the infrastructure related to currency production. This involves collaborating with various printing presses, mints, and facilities to ensure that banknotes and coins are manufactured and supplied in line with demand.

Recent Developments in Currency Management

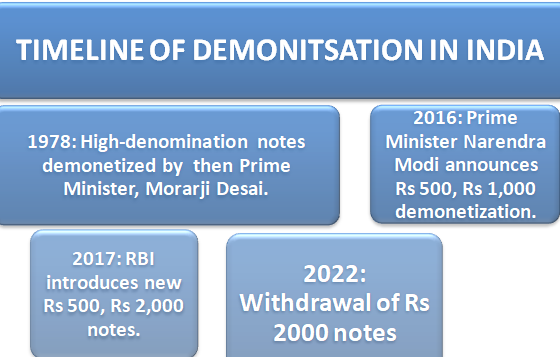

In the realm of currency management in India, significant developments have unfolded in recent history, with instances of demonetization making a profound impact on the country’s monetary landscape. The first notable episode occurred in 1978 when the government decided to demonetize higher-denomination banknotes, including the Rs 1000, Rs 5000, and Rs 10,000 denominations. The second wave of demonetization swept across the nation in 2016, leading to the invalidation of the Rs 500 and Rs 1000 banknotes. More recently, in 2022, another change was introduced as the Rs 2000 banknotes were taken out of circulation. These transformative actions have not only influenced the daily transactions of citizens but also played a crucial role in shaping the dynamics of currency management in the country.

Procedure for withdrawing legal tender status

The process for withdrawing the legal tender status of banknotes is outlined in Section 26(2) of the RBI Act, 1934. As per this section, the central government, upon the recommendation of the Central Board of the RBI, can issue a notification published in the Gazette of India. This notification specifies that a particular series of banknotes of any denomination will no longer be considered legal tender starting from the date mentioned in the notification. In a revelation from an RTI response, it was disclosed that the decision for the 2016 demonetization, during which the Rs 500 and Rs 1000 banknotes were invalidated, received approval from the RBI Board just hours before the announcement by the then Prime Minister Narendra Modi.

Developments in Currency in Circulation

The Currency in Circulation (CIC) encompasses banknotes and coins, serving as the lifeblood of everyday transactions in India. The Reserve Bank plays a pivotal role in this ecosystem by issuing a spectrum of banknotes with denominations ranging from two to two thousand rupees. Additionally, various coins, including 50 paise and 1, 2, 5, and 10 rupee coins, are in active circulation. Regarding value, banknotes dominate the CIC, constituting approximately 99 percent of the total, reflecting their prominence in facilitating economic exchanges and financial transactions. This dynamic interplay of banknotes and coins underpins the economy’s day-to-day functioning.

Fiat Currency: The Backbone of Modern Economies

In today’s global financial landscape, fiat currency is the cornerstone of monetary systems. Unlike currencies tethered to tangible assets like gold, fiat currency issued by the Reserve Bank of India holds an intrinsic value significantly higher than its extrinsic cost. For instance, the production expense of a 100 Rupee note is considerably lower than its inherent value.

Across the world, nations rely on fiat currency as the primary medium of exchange. Each country establishes specific criteria for currency issuance, typically linked to foreign exchange reserves or precious metals such as gold. In India, the Minimum Reserve System is the guiding principle, necessitating the Reserve Bank of India to maintain a minimum backing of Rs. 200 crores, ensuring the stability and integrity of the nation’s currency system. This monetary framework empowers central banks to be crucial in shaping economic policy and safeguarding financial stability.

Summing Up

Currency management by the Reserve Bank of India is vital for economic stability and daily transactions. The issuance of fiat currency, governed by dynamic principles, empowers the nation’s financial system. Aspiring professionals can benefit from resources like ixamBee while preparing for RBI Recruitment Exams, ensuring a skilled workforce for India’s currency management.

Prepare with ixamBee

Embarking on the journey to become an RBI Grade B Officer commences with thorough preparation for the upcoming RBI Grade B exam 2024. ixamBee provides various resources for the RBI Grade B exam preparation, like the RBI Grade B Exclusive Online Course, RBI Grade B free mock tests, and RBI Grade B previous year question papers.

To help you prepare 50% faster for competitive exams, ixamBee provides a free Mock Test Series and all the Current Affairs in English and Current Affairs in Hindi in the BeePedia capsules for GA Preparation. You can also get the latest updates for Bank PO, Bank Clerk, SSC, RBI Grade B, NABARD, and Other Government Jobs.

ALSO READ

RBI Grade B Phase 2: Writing Segment Preparation

RBI Grade B Exam 2024: General Awareness Preparation

RBI: Full Form and Other Information

![List of Joint Military Exercises of India [2020]](/blog/wp-content/uploads/2020/03/Copy-of-Blog-new-11-100x70.png)

![List of Mountains in India [Updated] copy of blog news](/blog/wp-content/uploads/2020/03/Copy-of-Blog-new-5-218x150.png)