Becoming an RBI Grade B Officer isn’t just a job. It’s a role of national importance. RBI Grade B Officer are at the helm of shaping India’s monetary policy, regulating the banking system, overseeing digital payments, managing inflation, and strengthening financial stability. In short, they build the financial backbone of the country.

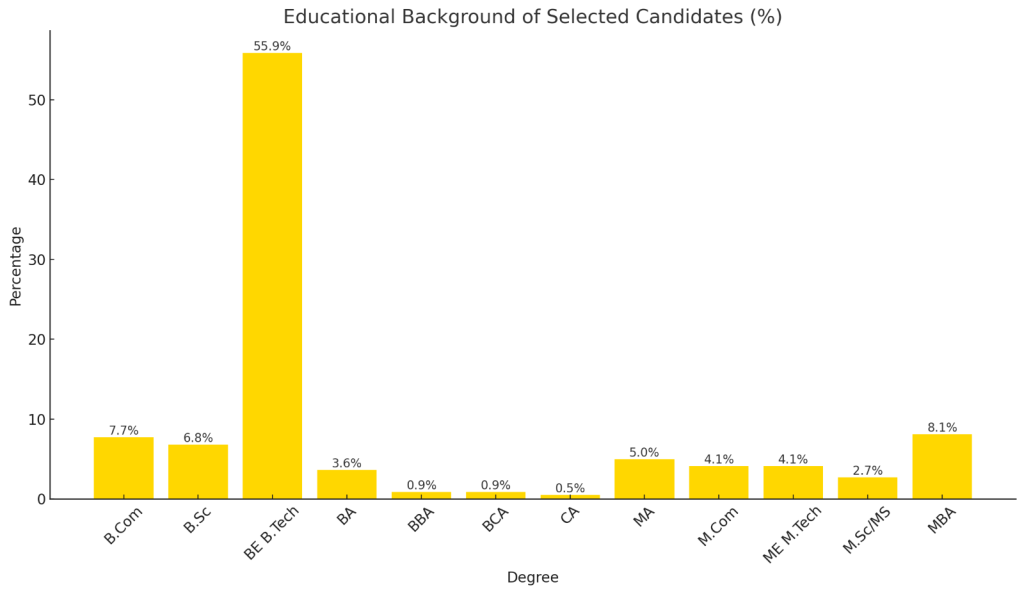

Most people think that those who work with RBI are experts in Finance and Accounts. But the facts are contrary. I have collated the profile details of RBI Grade B officers of the 2024 and 2023 batch.

RBI Grade B Officer: Why Background Doesn’t Matter

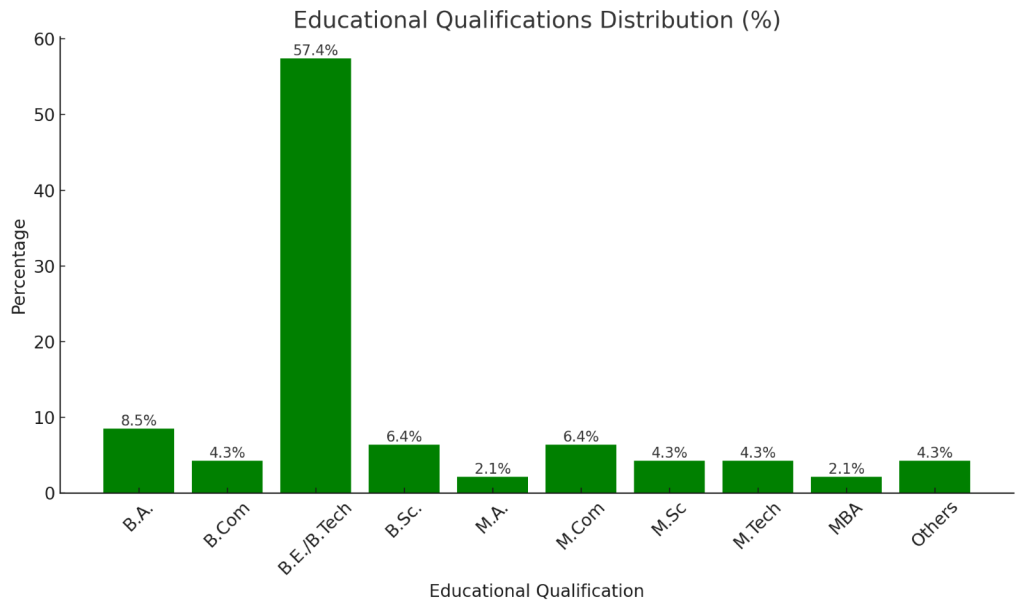

We have provided some important details which prove that background doesn’t matter for RBI Grade B Officer. Take a look at the graph below for some important details:

The graph above represents selected candidates of RBI Grade B 2024. Those who come from Finance and Commerce backgrounds are only 13% of the selected candidates. This clearly indicates that the knowledge of finance, accounts and economics is not the most decisive factor for selection in RBI Grade B. The trend in year 2023 was not very different, in which the number of candidates from Finance & Commerce background were 20%. Have a look at the chart below:

Further analysis reveals that selected candidates include Commerce & Economics grads, B.A., B.Sc., M.A., M.Com., even non-finance MBAs, Freshers with no experience, Working professionals, Candidates who took 1, 2, or more than 3 attempts and those with career gaps.

Some candidates think that there is a preference for candidates from a certain state or language. This is an excuse for the lack of of their preparation. The data is loud and clear, showing representation of various states.

Someone who is 21 years old also gets selected and someone who is 31 years old also gets selected for the same exam. Most of the selected people are 25 years and above in the age that may indicate serious preparations time for grade B exam.

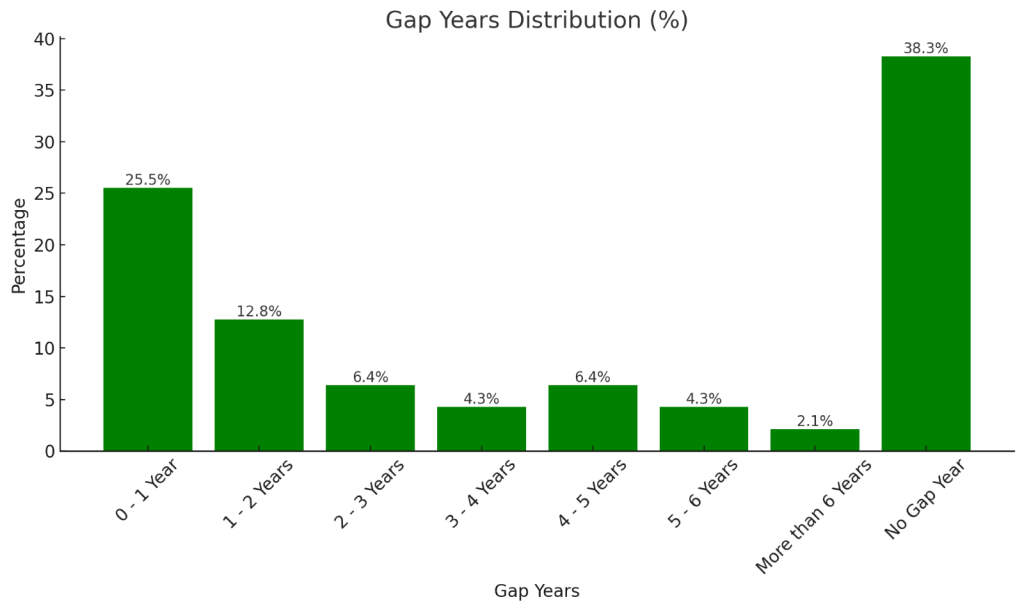

Most candidates, especially those who have been preparing for UPSC Civil Services Exam for years, get nervous in the interview, if they have gap years. But it doesn’t seem relevant for the selection in RBI Grade B. The graph below shows some more details:

Working Professionals and RBI

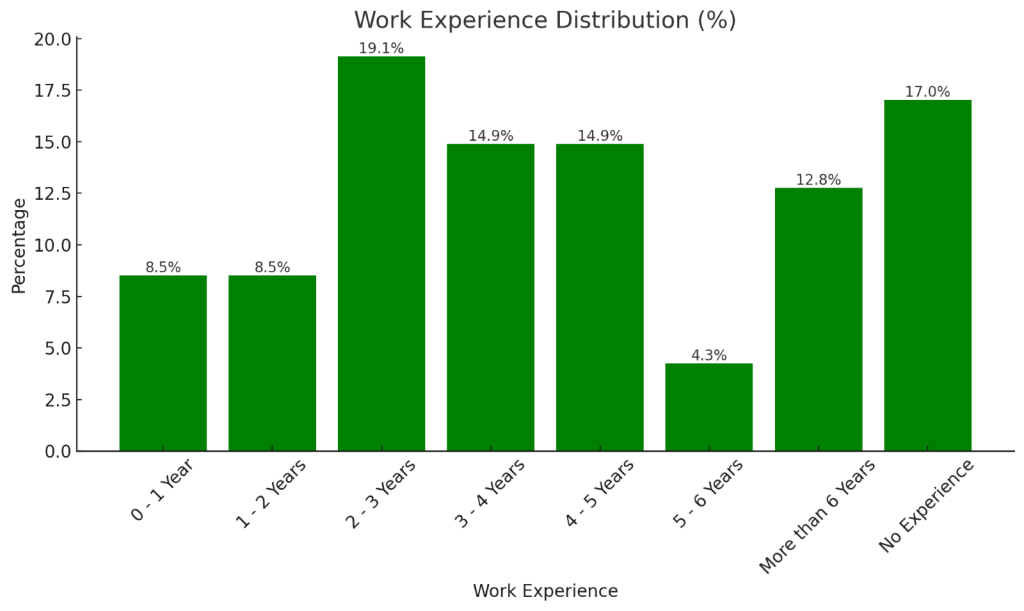

Working professionals get less time for study, but still they get selected in the most numbers. The probable reason is that most of the bank officers, those who cleared IBPS PO, SBI PO, RRB PO or other such exams, need less preparation for Phase 1 of the RBI Grade B exam. Work experience also improves the power of expression that helps in scoring high in the descriptive questions.

In the interview, working professionals have a more guided path than the personal interview of a fresher, for whom most of the questions are academic. However, as shown in the graph below candidates with zero experience are 17% of the selected ones, which is a very god number for such a competitive exam. More details are here:

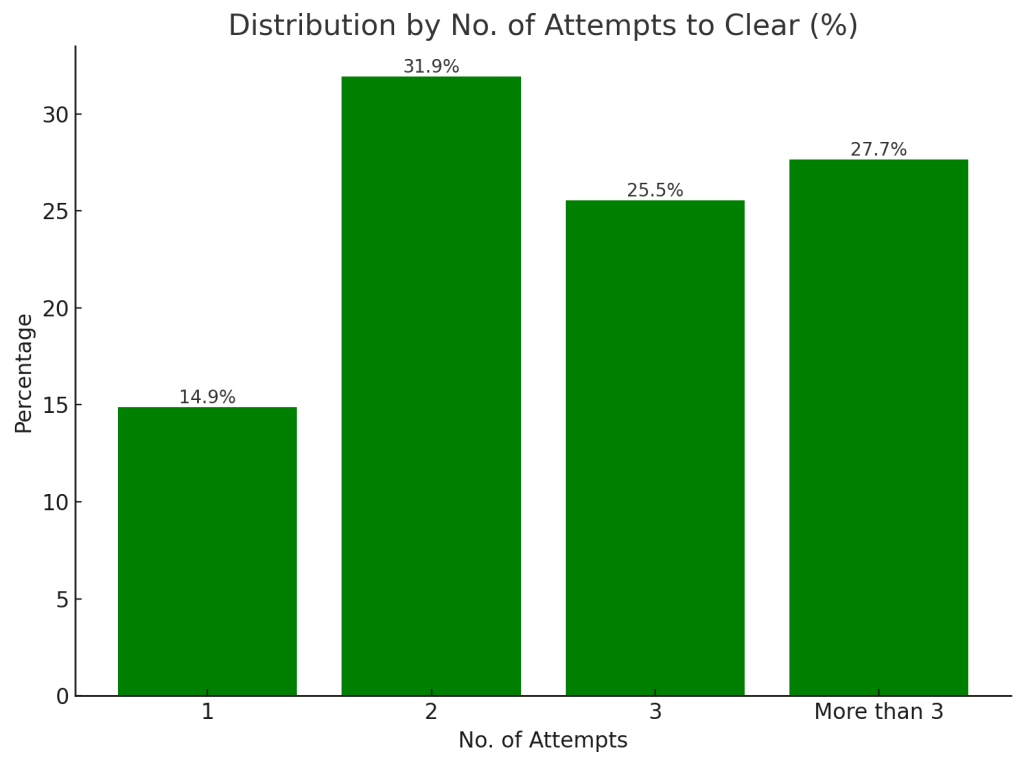

Many candidates consider their first attempt at RBI Grade B a trial to see the exam. The fact is ~15% of the selected candidates become RBI Grade B office in the first attempt in the exam. More candidates are there with more than 1 attempts as mentioned in the graph below:

What Makes an RBI Officer So Special?

As an RBI Grade B officer, you’ll have a front-row seat to the country’s economic engine. You may:

- Contribute to policy on inflation, liquidity, and interest rates

- Work on digital currency and financial inclusion frameworks

- Interact with international regulatory bodies

- Shape guidelines for banks, NBFCs, and fintech platforms and also participate in their inspections

- Help stabilize markets during financial crises

This is one of the most respected and intellectually stimulating jobs in Indian governance—and a direct path to leadership roles in India’s financial system.

So How Do You Get There?

Simply put, It’s all about preparation. The RBI Grade B Exam is rigorous—but clear in pattern. Success doesn’t depend on your degree; it depends on how well you master the following:

Phase 1 (Screening)

RBI Grade B recruitment has three phases. Phase I is the screening phase and it includes the following topics:

- Quantitative Aptitude

- Logical Reasoning

- English Language

- General Awareness (with emphasis on Economy & Finance)

Phase 2 (Merit Deciding)

Following the screening phase, those who clear Phase I progress to Phase II which has the following segments:

- Economic & Social Issues (ESI): 50% Objective + 50% Descriptive

- Finance & Management (F&M): 50% Objective + 50% Descriptive

- English Descriptive Writing (Essays, Reports, Comprehension): 100% Descriptive paper

You don’t need to be a finance expert when you start. The syllabus is well-defined. As we have seen in the charts above, large numbers of engineers and humanities students crack it by starting from scratch and studying smart.

We have prepared a study guide for RBI Grade B preparation, the link to download is here;

RBI Grade B Preparation Helps You Crack Other Regulatory Exams Too

Preparing for RBI Grade B has a massive bonus: it opens the door to almost every top-tier financial regulator and development institution, including:

- SEBI (Securities and Exchange Board of India)

- IRDAI (Insurance Regulatory and Development Authority of India)

- PFRDA (Pension Fund Regulatory and Development Authority)

- IFSCA (International Financial Services Centres Authority)

The subjects, difficulty level, and paper style are very similar. With a few tweaks, your RBI prep makes you competitive across the board.

Final Word: Don’t Dismiss Yourself. Prepare.

If you’ve ever thought:

- “I’m from a non-finance background.”

- “I don’t have work experience.”

- “I’ve had gap years.”

- “I’m not from a top college.”

Let this be your wake-up call: none of those matters.

RBI selects candidates who understand the exam, master the subjects, and write with clarity. Your degree isn’t the filter. Your preparation is.

Without delay, you must watch the best course for RBI Grade B preparation, which is prepared by ex-RBI officers. You can visit the RBI Grade B Demo Course while preparing.

About the Author – Chandra Prakash Joshi

Chandra Prakash Joshi, one of the founders of ixamBee is an Ex AGM RBI, Ex SVP Yes Bank, with 13 years of senior-level experience in the banking & finance sector. He joined the Reserve Bank as an RBI Grade B Officer in 2004 (AIR 5). In 2008 , he was promoted to AGM (Grade C), one of the first three in his batch to receive this promotion. He holds a Ph.D.(Development Communication) and is an MBA (ISB Hyderabad.

ixamBee specializes in providing expert guidance and resources for banking exams 2025, ensuring that you are well-prepared for the Upcoming Bank Exams like RBI Grade B, NABARD Grade B, IBPS SO, and more. Our courses align with the bank exam calendar 2024, covering all the essential topics. With a focus on the upcoming bank jobs, our Previous Year Papers, BeePedia, SSC CGL, SSC CHSL, SSC MTS and other Mock Tests are designed to help you excel in upcoming banking exams.

Also Read:

UPSC EPFO EO/AO Recruitment 2025: Details You Should Know

Cracking SIDBI , PFRDA and BoB LBO Exams Together: Easy Preparation Strategies.

Empowering Women Entrepreneurs: SIDBI’s Initiatives for Women‑Led Microenterprises