Throughout the world, Insurance has become one of the major drivers of national economies. It not only protects the health and assets of the people but also stimulates business activities to operate in a cost-effective manner. The insurance sector has the potential to raise long-term capital from the masses. It is the only avenue where people invest money for a longer period.

Insurance is one of the sensitive sectors as it holds the money of people for the long term. Attempts made in the past to open up the insurance sector to foreign investors were in vain. Even after the liberalisation in the insurance sector, the public sector insurance institutes continued to dominate the insurance market, enjoying approximately 90% of the market share. But the recent move by the Central Government to increase the FDI limit from 49% to 74% in Insurance Companies, announced in the Union Budget 2021-22, is a boon to the Indian economy. Increased FDI in insurance can enhance penetration of insurance in India besides meeting India’s long term capital requirements to fund the building of infrastructures. The move has surely opened the gateway to boost the growth model but a check on it is necessary. Thus, RBI in association with IRDAI has joined hands to scrutinise the FDI applications in an insurance firm that has been promoted by Private Bank to adhere to these limits and keep a check that they are not breached.

Let’s check what this FDI stands for and its importance.

What Is FDI?

The role of FDI in the present world is noteworthy as it acts like lifeblood in the growth of developing nations. FDI or Foreign direct investment is the injection of foreign funds into an enterprise/ business entity that operates in a country that is different from the financier country. FDI is a vital part of an open and real international economic system and promoter of development. It has become one of the major forms of international capital transfer for the last many years. There are two ways through which FDI is operated in India.

- Automatic Route – Here the non-resident investor/ Indian company (if investing abroad) does not require any approval from Central Government for the investment. RBI is the sole checker of such a route.

- Government Approval Route– Here the approval from the Government of India is necessary before investment. Such proposals are considered by the respective Administrative Ministry/ Department for which the investment has to be made.

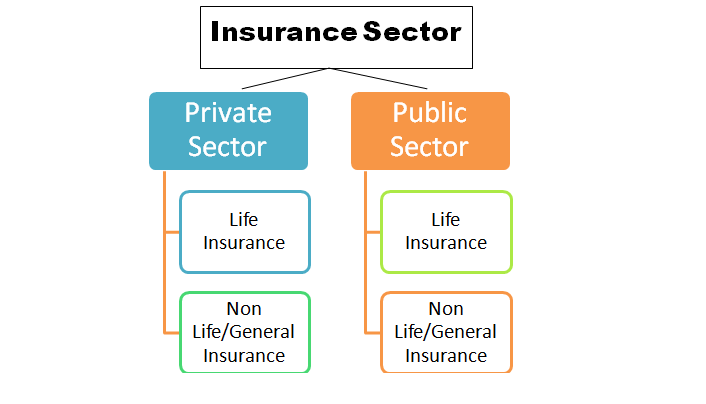

Insurance Sector Info

The Indian Insurance Sector has been categorized into two categories – Life Insurance and Non-life Insurance. IRDAI or the Insurance Regulatory and Development Authority of India is the regulator for both Insurance and Non-life Insurance. Currently, there are 24 life insurance companies and 34 non-life insurers companies.

Some Important Points Regarding Insurance

The insurance sector has undergone many changes over the years whose crisp summary is provided below.

- Nationalisation of life insurance through LIC Act 1956 and non-life insurance sector through GIC Act 1972

- Establishment of IRDAI in 1999

- Opening of the Insurance Sector to both private and foreign players in 2000

- Enhancement in foreign investment cap from 26% to 49% in 2015

- The enactment of 100% foreign direct investment (FDI) for insurance intermediaries in the Union Budget 2019-20

FDI Importance in Insurance Sector

Currently, the Insurance penetration in India stands at 3.7% of the GDP compared to the world average of 6.31%. Also, the insurance sector growth has slowed to 11-12% from 15-20% for 2020 as the COVID-19 pushed people to save cash instead of spending on stocks/ life insurance policies. Raising the FDI bar in the Insurance sector was the need of the hour to strengthen the basic insurance infrastructure of the country.

Besides this, some merits of increased FDI in insurance are listed below.

- A higher FDI limit will help insurance companies access more foreign capital to meet their growth requirements reducing their dependency on Banks, NBFCs to meet their capital requirements

- It will make the insurance sector more competitive, transparent and efficient

- Penetration of insurance in the country will improve

- Better technical know-how, innovation and new products will be available to the consumers

- Global best practices inclusion in terms of insurance products

- Wider choice of insurance services as access to innovative products along with better claims settlement experience

- The cost of insurance products in India will be reduced as there will be more options to choose from

- Increased FDI will help local private insurers grow fast and expand their presence across India

- FDI in insurance will scale up insurance operations resulting in significant employment of semi-skilled insurance agents and sales workforce

Also, Dr. Guruprasad Mohapatratoday, Secretary, DPIIT, Ministry of Commerce and Industry, said – enhanced FDI in insurance will enable global insurance companies to take more strategic and long-term view on the Insurance sector in India, thereby bringing in greater inflow of long-term capital, global technology, processes and international best practices.”

Conclusion

I won’t be exaggerating if I say that FDI is a bonanza for the Indian insurance sector. The Insurance sector assumes an important part within the financial improvement and India being one of the most promising emerging insurance markets in the world should attract FDI to build its growth infrastructure. The sector needs more infusion of capital and larger participation of the international partner for the evolution and availability of global products in the country.

At ixamBee you can find free Online Test Series, GK updates in the form of BeePedia, as well as latest updates for Bank PO, Bank Clerk, SSC, RBI, NABARD, and Other Government Jobs.

Also Read,

Difference between FDI, FII and FPI