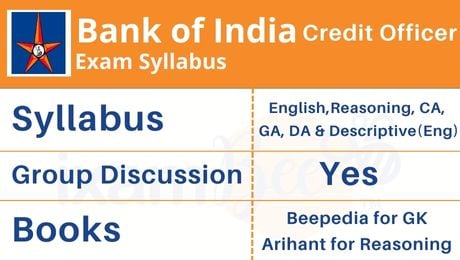

Bank of India Credit Officer Syllabus

Before starting the preparation for the exam, it is very important to look at the BOI Credit Officer 2026 syllabus and exam pattern. BOI Credit Officer exam syllabus includes questions from four sections, basically, English Language, Reasoning, Quantitative Aptitude and Professional Knowledge.

While English, Reasoning, and Quantitative carry 25 marks each for 25 questions, the professional knowledge section carries 75 marks for 75 questions. The total composite time is 120 minutes, and the total marks are 150.

The above tests, except the Test of English Language, will be available bilingually, i.e., English and Hindi. The test of English Language will be of a qualifying nature, i.e., Marks obtained in English Language will not be added while preparing the merit List. There will also be a penalty for wrong answers.

The detailed BOI Credit Officer exam pattern and the syllabus details are given in the table below.

Credit Officer in General Banking Stream

| Section | Topics |

|---|---|

| English Language | Articles, Adverbs, Verb Agreement, Idioms and Phrases, Tenses, Error Corrections, Vocabulary, Comprehensions, Grammar, Sentence Arrangements, Fill in the blanks, Synonyms, Unseen Passages, Error Correction |

| General Awareness with special reference to Banking Industry | Banking & Financial Awareness, Monetary Policies, Economic Terms, Current Affairs, Static GK, Financial & Economics News, Government Schemes, Agreement & Deals, Banking terms, rates, processes |

| Financial Management | Accounting Concepts: Marginal Costing, Social Accounting, Absolute Costing, Cost Volume Profit Analysis, Activity-based Costing, Inventory valuation, Cost Sheet and work, Target Costing, Transfer pricing, Overview of Cost Accounting Guidelines of SEBI |

| Corporate Accounting: Insurance of shares, Divisible Profits and Bonus Issues, Dividend Distribution, Final Accounts factories Act, Underwriting, Valuation of Goodwill and shares, Capital, Issues, Forfeiture, and Reissues of shares, Accounting for Amalgamation companies, Issues and Redemption of Debentures, Acquisition of Business and profits before Incorporation | |

| Business Law: Provident Fund, Industrial Dispute Act, Labor Law, Process Costing, Negotiable Instruments, Gratuity Act, Redemption of preference shares, Partnership act, Contract act, Marginal Cost and Cost Volume Profit | |

| Management Accounting: Ratio Analysis, Cash Flow Statement, Budgeting and Budgetary Control, Capital Market, Sources of Finance, Capital Structure, Company Law Analysis, Standard Costing and various Analysis, Capital Budgeting | |

| Capital Structure: Cost of capital, Funds flow statement, Sources of Finance, Job and Batch Costing, The material, Labor cost, and Overhead cost, Financial Statement Analysis, Sources of finance, Process Costing, Contract Costing, Budgeting and Budgetary Control | |

| Economics: Micro and Macro Economics concepts, Updates related to money market and RBI Policies, Money Market | |

| Basic Accounting: Principle and concepts of Accounting, How the RBI, IRDA, and SEBI works – Functioning |

IT Officer in Specialist Stream

| Subjects | Topics |

|---|---|

| DBMS | DBMS Schemas (Hierarchical, Network, Relational), Relational Model Concepts, DML, DDL, Basic SQL, Oracle concepts, Basics of Indexing, Normalization, Entity Relationship Model |

| Operating Systems | Functions of OS, Basics of Memory Management, DML, DDL, Basic SQL, Oracle, concepts, Process Concept, Threads, Security, Multiprogramming, Synchronization Concepts, Spooling, Page Replacement Policies |

| Data Communication and Networking | OSI Model, TCP/IP Suit, IPv4 Addressing, IP header, Subnet Mask, Mac Address, ARP and RARP and DHCP, Switching and Routing, Common Network Protocols (Telnet, HTTP, FTP, SNMP, PPP,UDP, ARP etc., Network Devices (Switch, Hub, Repeater, Router, Modem etc), LAN, MAN, WAN, Network Security |

| Basics of Programming and Data Structures | C, C++, Java Basics, OOPS Concepts, Array, Strings, Heap & Priority Queue, Queue, Linked List, Stack |

| Software Engineering | Software Development Models(Waterfall, RAD, Prototyping, Spiral), Design and Analysis, Data Flow Diagram, Software Requirement, Software Testing (Black, White, Grey Box), Software Maintenance and CASE tools |

| Computer Organization & Architecture | 8085 and 8086 (Flags and Interrupts), Memory Hierarchy & System Bus |

| MS Office & Windows and Web Technologies | HTML, Javascript Basics, Cookies, Search Engine Basics Client Server Model |

| Miscellaneous | Recurrence Relation, Planar Graphs, Relation, Regular Expression, Data Mining, Sorting, Finite Automata, Data Mining, Sorting, Algorithms to Find Shortest Path |

| Digital Logic | Logic Gates, Combinational Circuits, Number System, Hamming Distance, Basics of Counters |

| Computer Hardware | ROM/RAM, BIOS, Bootstrap Memory, Hard Disks, Peripheral Devices, Compiler, Assembler, Linker, Macro Processor, Loader, translator |

Important Books for BOI Credit Officer

The Bank of India Credit Officer exam is an important examination that requires a lot of hard work along with smart work. Any preparation is incomplete without good and trustworthy study material.

You should know which books to go for so that you do not waste your precious time reading and rejecting certain books. To help you with the preparation, we are providing some books which can be useful for the Bank Of India Credit Officer exam.

Credit Officer in General Banking Stream

| Paper | Books | Author/Publisher |

|---|---|---|

| General Awareness | Banking Awareness | Arihant Publication |

| Static General Knowledge | Arihant Publication | |

| General Knowledge | Lucent | |

| Banking Awareness Handbook of Banking Information | N.S Toor | |

| Finance & Management | Financial Management | Prasanna Chandra or IM Pandey |

| Indian Financial System | Bharti Pathak | |

| Principles of Management | LN Prasad | |

| Organisational Behaviour | SP Robins | |

| English Language | English Grammar | Wren & Martin |

| Word power made easy | Norman Lewis | |

| Descriptive General English | SP Bakshi |

IT Officer in Specialist Stream

Subject Author

Data structure

Aron M Tenenbaum

Dbms

Kurth and Sudarshan

Operating system

Galvins

Networking

Andrew S Tenenbaum

SQL

mysql

Algorithms

Thomas h comments

Oops for c++ and Java

The complete reference

Software engineering

Roger s pressman

Data warehousing

Paulraj ponniah

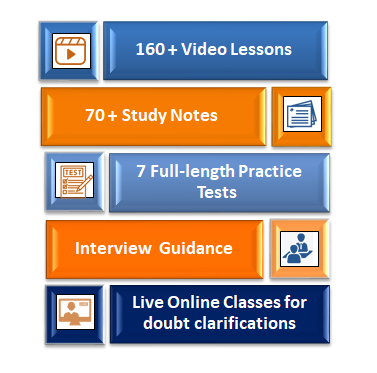

Bank of India Credit Officer Online Course 2026

Many aspirants work hard to crack the exam, but a lack of correct guidance shatters their dreams. ixamBee Bank Of India Credit Officer exam course will help you in fulfilling your dreams.

The Bank Of India Credit Officer course has been curated under the guidance of the faculties that have rich and diverse experience in the banking and financial sectors. The BOI Credit Officer study material has been designed keeping the latest exam pattern and question level in mind.