Question

How many persons live between the floors on which F and

G live? Study the following information carefully to answer the given questions: Seven Persons – A, B, C, D, E, F, and G – live on separate floors of a seven storey building, but not in the same order. The ground floor of the building is numbered 1, the floor above it 2 and so on until the topmost floor is numbered 7. Each person likes different pens – Pilot, Parker, Montblanc, Reynolds, Linc, Pelikan and Classmate, but not necessarily in the same order. Each person like different pencil namely viz – Apsara, Nataraj, Camlin, Doms, Pentonic, Faber castell and Staedtler. (i) Two persons live between the persons who like Staedtler and Nataraj. The person who likes Reynolds lives on floor numbered four. A does not live on the lowermost floor. A lives on any odd numbered floor below the one who likes Reynolds. (ii) Only two persons live between A and the person who likes Classmate. Two persons live between the persons who like Apsara and Camlin. Only one person lives between B and F. F lives on an even numbered floor and does not like Reynolds. (iii) Only three persons live between the persons who like Pilot and Montblanc respectively. The person who likes Pilot live on any floor above the B’s floor. There are two persons live between the persons who like Nataraj and Pentonic. (iv) The person who likes Pilot does not live on the topmost floor. G does not like Doms. G lives on an even numbered floor but neither immediately above nor immediately below the floor of A. C does not like Pilot or Montblanc. (V) Only two persons live between D and the one who likes Reynolds. The person who likes Staedtler lives on one of the floors above the floor numbered 5. The person who likes Linc lives on the floor immediately above the floor of the person who likes Pelikan. (vi) The person who likes Nataraj lives on one of the floors above the floor numbered 3. The person who likes Apsara lives immediately above the one who likes Nataraj. There are two persons live between the one who likes Faber castell and the one who likes Doms.Solution

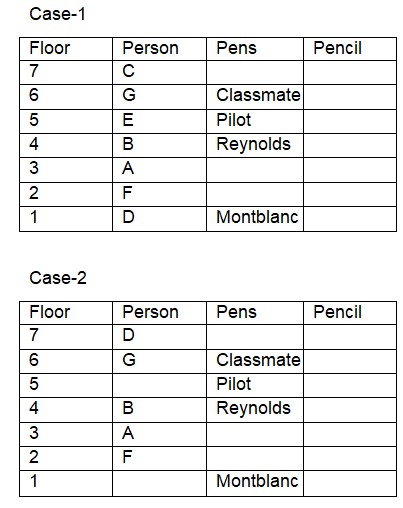

From (i), (ii) and (iv), we will get the basic information as shown below:  From (i), A lives on floor no. 3. From (iv), G cannot live on floor no. 4 and 2. So, G lives on floor no. 6. From (v), we will have two cases: D lives either on floor no. 1 or 7. From (ii), F lives on floor no. 2 and B lives on floor no. 4. The one who likes Classmate lives on floor no. 6. From (iii), The one who likes Pilot and Montblanc live on floor no. 5 and 1 respectively. From (iv), C lives on floor no. 7. Case 2 will get discarded as C does not like neither Pilot nor Montblanc.

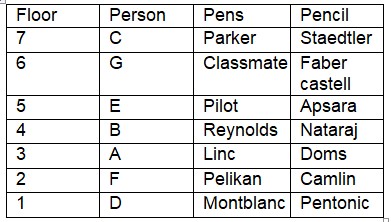

From (i), A lives on floor no. 3. From (iv), G cannot live on floor no. 4 and 2. So, G lives on floor no. 6. From (v), we will have two cases: D lives either on floor no. 1 or 7. From (ii), F lives on floor no. 2 and B lives on floor no. 4. The one who likes Classmate lives on floor no. 6. From (iii), The one who likes Pilot and Montblanc live on floor no. 5 and 1 respectively. From (iv), C lives on floor no. 7. Case 2 will get discarded as C does not like neither Pilot nor Montblanc.  From (iii) and (vi), the persons who like Nataraj lives on floor no. 4. The person who likes Apsara lives on floor no. 5. From (i), the person who likes Staedtler lives on floor no. 7. From (v), the one who likes Faber castell and Doms live on floor no. 6 and 3 respectively. Only pencil left for floor no. 2 is Camlin. From (v), The person who likes Linc and Pelikan lives on floor no. 3 and 2 respectively. Only pen left for floor no. 7 is Parker. Final arrangement as shown below:

From (iii) and (vi), the persons who like Nataraj lives on floor no. 4. The person who likes Apsara lives on floor no. 5. From (i), the person who likes Staedtler lives on floor no. 7. From (v), the one who likes Faber castell and Doms live on floor no. 6 and 3 respectively. Only pencil left for floor no. 2 is Camlin. From (v), The person who likes Linc and Pelikan lives on floor no. 3 and 2 respectively. Only pen left for floor no. 7 is Parker. Final arrangement as shown below:

"What nutrient deficiency is responsible for interveinal chlorosis?"

Sowing depths for maize and semi dwarf wheat seeds are

Vertisol order soil is found maximum in which state?

What is the minimum germination percentage of wheat?

With reference to micro-irrigation, which of the following statements is/are correct?

1. Fertiliser/nutrient loss can be reduced.

...Food analyst analyse, prepare report and send to designated officer (DO) for copies of report indicating the method of sampling and analysis within ____...

A non-membrane bound organelle found exclusively in animal cells is _________.

Which of the following Nitrogen Fertilizer is partly soluble?

Assartage system is related with

The rats are medium-sized rodents belonging to the family called……………..

Relevant for Exams: