Question

Under the Differential Rate of Interest (DRI) Scheme,

banks provide finance up to ______ at a concessional interest rate of 4% per annum for eligible weaker sections.Solution

Under the Differential Rate of Interest (DRI) Scheme, banks provide finance up to ₹15,000 at a concessional interest rate of 4% per annum. Differential Rate of Interest (DRI) Scheme • Purpose: The DRI Scheme aims to uplift weaker sections by offering financial assistance at a reduced rate, enabling them to pursue productive, self-employment, or income-generating activities. This concessional financing supports economic independence and financial inclusion. • Eligible Groups: o Primarily targets Scheduled Castes (SCs), Scheduled Tribes (STs), minorities, physically handicapped individuals, and people involved in cottage and rural industries. o Individuals who collect forest products or fodder are also eligible, extending financial support to communities that rely on natural resources for livelihood. • RBI Mandate for SC/ST Allocation: The Reserve Bank of India has instructed banks to ensure that at least 40% of DRI Scheme advances go to borrowers from SC/ST communities, reinforcing the scheme’s commitment to social equity.

(560 ÷ 32) × (720 ÷ 48) = ?

∛857375 + ∛91125 = ? + √6889

? = √2704 ÷ (25% of 104) + 73

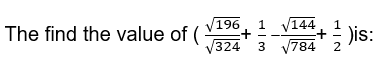

What will come in the place of question mark (?) in the given expression?

(5/8) × 1600 + (2400 ÷ 25) = ?

50 ÷ 2.5 × 64 + ? = 1520

[(√ 529) + 67] x 5 = ?

182 – 517 ÷ 11 - √361 = ?

In the question, two Quantities I and II are given. You have to solve both the Quantity to establish the correct relation between Quantity-I and Quantit...

(3/7) of 700 + 33(1/3)% of 339 - 69 =?