Question

What percentage of assets does Tata AIA's Rising India

Fund aim to allocate towards equity and related instruments to achieve capital appreciation?Solution

Tata AIA's Rising India Fund's investment strategy includes allocating a substantial 70-100% of its assets towards equity and related instruments. This aggressive allocation is designed to maximize capital appreciation by investing in pivotal sectors and companies contributing to India's growth. The remaining 0-30% is directed towards debt and money market instruments, balancing risk while aiming for growth.

क्ष, त्र और ज्ञ की गणना स्वतन्त्र वर्णों में नहीं होती क्य�...

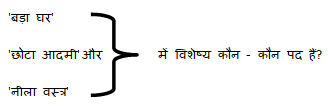

निम्न में से कौन सार्वनामिक विशेषण का उदाहरण है?

'गुरुकुल' शब्द में कौन सा समास है?

'र' का विवरण है

मुख्य क्रिया के अर्थ को स्पष्ट करने वाली क्रिया होती है

अन्नजल में कौन सा समास है

जंहा मुफ्त में खाना बंटता हो ,उसके लिए एक शब्द क्या होगा ?

दिए गए शब्दों के शुद्ध वर्तनी के लिए चार विकल्प दिए गए हैं�...

निम्नलिखित में से कौन – सा सुमेलित युग्म नहीं है?

Relevant for Exams: