Question

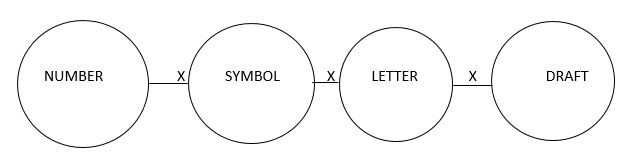

Statements: No number is a symbol. No

symbol is a letter. No letter is a draft. Conclusions: I. No number is draft. II. Some letters are not symbols. III. Some drafts are not symbols. In each of the questions below are given three statements followed by three conclusions numbered I, II and III. You have to take the given statements to be true even if they seem to be at variance with commonly known facts. Read all the conclusions and then decide which of given conclusions logically follows from the given statements disregarding commonly known facts.Solution

No number is a symbol(E) + No symbol is a letter(E) ⇒ No conclusion. Hence, conclusion I does not follow. No symbol is a letter(E) ⇒ Conversion ⇒ Some letters are not symbols (O). Hence, conclusion II follows. No symbol is a letter(E) + No letter is a draft(E) ⇒ No conclusion. Hence, conclusion III does not follow. ALTERNATE METHOD:

Which of the following Statements about IREDA is/are True?

I- It is registered as Non-Banking Financial Company (NFBC) with Reserve Bank of India...

Which of the following Statements about Multiplier Effect is/are True?

I- When the government spends a rupee, overall income rises by a multiple ...

What is the basic difference between Gross NPA and Net NPA?

I- Gross NPA is the total of Bank loans and Net NPA is the total of all kinds of loan...

Consider the following statements regarding Phase II of the Swachh Bharat Mission (Grameen) [SBM (G)]

1) The program will be implemented...

Which of the following statements about Prompt Corrective Action is/are True?

I- Prompt Corrective Action F...

Who among the following is not one of the eligible beneficiaries of PMUY?

When Government expenditure is more than income, through which of the following ways, it does the deficit financing?

(1) From Banks

(2) Fr...

Relevant for Exams: