Question

Who among the following person sits third to the right

of the one who likes Blue mint? Study the following information carefully and answer the below questions Six persons P, Q, R, S, T, and U are sitting around the rectangular table such that two persons were seated at each long side, and one person was seated at each shorter side of the table and they are all facing inside. They like different ice cream flavours Chocolate, Vanilla, Black walnut, Strawberry, Blueberry, and Blue mint. All the information is not necessarily in the same order. Q and R are not immediate neighbours. The one who likes Black walnut sits second to the left of the one who likes Blueberry who sits at the bottom side of the rectangular table. T and U are sitting diagonally opposite to each other. Q and the one who like Vanilla are immediate neighbours. U likes Chocolate who sits third to the left of the one who likes Black walnut and U is an immediate neighbour of the one who likes Blue mint. Only one person sits between P and the one who likes blueberry.Solution

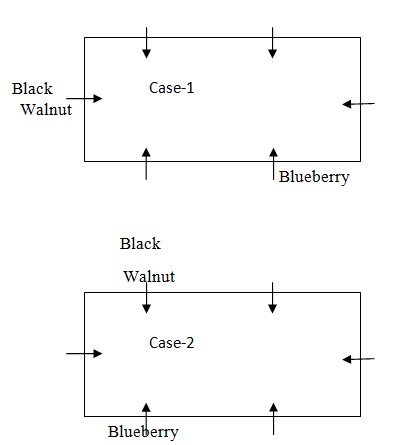

The one who likes Black walnut sits second to the left of one who likes Blueberry who sits at the bottom side of the rectangular table. From the above conditions, there are two possibilities .  U likes Chocolate who sits third to the left of the one who likes Black walnut and U is an immediate neighbor of the one who likes Blue mint. T and U are sitting diagonally opposite to each other.

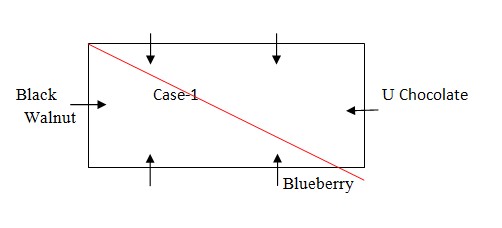

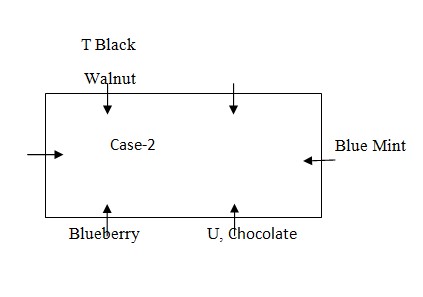

U likes Chocolate who sits third to the left of the one who likes Black walnut and U is an immediate neighbor of the one who likes Blue mint. T and U are sitting diagonally opposite to each other.

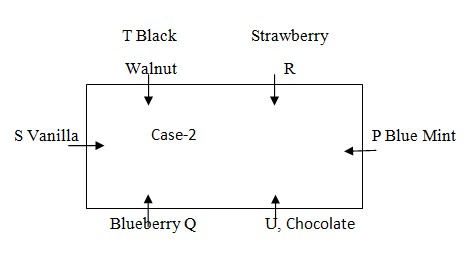

Q and the one who like Vanilla are immediate neighbors. Q and R are not immediate neighbours. Only one person sits between P and the one who likes blueberry. From the above condition, Case2 shows the final arrangement.

Q and the one who like Vanilla are immediate neighbors. Q and R are not immediate neighbours. Only one person sits between P and the one who likes blueberry. From the above condition, Case2 shows the final arrangement.

Who has been appointed to the Supreme Court committee for drafting an equal opportunity policy for transgender rights?

The Insurance Regulatory and Development Authority of India (IRDAI) has made changes to the approval process for insurance products.What changes have be...

Which Article of the Indian Constitution refers to the Rights of Ministers with respect to the State Legislature?

Which of the following is an indirect tax?

What is the name of the US-led silicon supply chain initiative that India was not included in?

Which new category has been introduced under the Pradhan Mantri Mudra Yojana to cover loans between ₹10 lakh and ₹20 lakh?

On which date was the 87th Foundation Day of the CRPF celebrated in 2025?

Who has been appointed as the new Chairman and Managing Director of Bharat Electronics Limited (BEL)?

_______ fintech payments and banking platform for businesses, will join the Open Network for Digital Commerce (ONDC), as an alternative for internet s...

Which mountain did Tripura mountaineer Aritra Roy successfully climb on 7 January 2026?