Question

Kanika Rawat has completed her graduation last year with

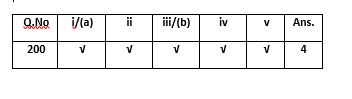

62% marks at the age of 20 years. She has scored 60% and 72% in the entrance and interview respectively. She is ready to pay Rs. 1,00,000 at the time of admission. Read the following information carefully and answer the questions given below: Following are the conditions for admission for a Postgraduate Course in a college: The students must be i. a graduate with at least 58% marks. ii. not more than 23 yrs as on March 31, 2017. iii. have secured at least 60% marks in the entrance examination. iv.have secured at least 65% marks in the interview carrying total marks of 150. v. be able to pay Rs.one lakh at the time of admission. However, if the student fulfils all the conditions except a. at (i) above, but has secured more than 75% marks in the entrance examination as well as in the interview, his/her case is to be referred to the Director.. b. at (iii) above, but has secured atleast 50% in the entrance exam and more than 85% marks in the interview, his/her case will be waitlisted.. You are given the following cases as on 01.04.2017. Depending upon the information provided in each case and based on the conditions mentioned above, recommend your decision. You are not to assume anything .Solution

The newly appointed chairman of National Bank for Agriculture and Rural Development is…………………

Who first used the term "mutation" to describe heritable, sudden phenotypic changes in organisms?

What is the main objective of using a disc harrow in secondary tillage?

Which of the following is most appropriate for blank “b”?

The study of plant nutrition and growth and crop production in relation to soil management is known as

Cell is the fundamental structural and functional unit of all living organisms. It was first discovered by ____

Which of the following fruit is highly drought tolerant?

An area having LGP 1 to 74 days is

Extra-long staple hybrid of cotton is

The process of removing the green colouring (known as chlorophyll) from the skin of citrus fruit. This is achieved by introducing measured amounts of et...

Relevant for Exams: