Question

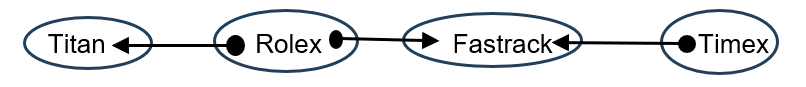

Statements: Only a few Rolex are Fastrack.

Only a few Rolex are Titan. Only a few Timex are Fastrack. Conclusions: I. All Fastrack being Timex is a possibility. II. Some Titan being Rolex is a possibility. III. Some Timex can be Titan. In each of the questions below are given some statements followed by some Conclusions. You have to take the given statements to be true even if they seem to be at variance from commonly known facts. Read all the Conclusions and then decide which of the given Conclusions logically follows from the given statements disregarding commonly known facts.Solution

Alternative Method: Some Timex are Fastrack (I) → Probable conclusion → All Fastrack may be Timex (A). Hence conclusion I follows. Some Rolex are Titan (I) → Conversion → Some Titan are Rolex (I). Hence conclusion II does not follows. Some Rolex are Titan (I) → Conversion → Some Titan are Rolex (I) + Some Rolex are Fastrack (I) → Probable conclusion → Some Titan are Fastrack (I) + Some Fastrack are Timex (I) → Probable conclusion → Some Timex can be Titan (I). Hence conclusion III follows.

Alternative Method: Some Timex are Fastrack (I) → Probable conclusion → All Fastrack may be Timex (A). Hence conclusion I follows. Some Rolex are Titan (I) → Conversion → Some Titan are Rolex (I). Hence conclusion II does not follows. Some Rolex are Titan (I) → Conversion → Some Titan are Rolex (I) + Some Rolex are Fastrack (I) → Probable conclusion → Some Titan are Fastrack (I) + Some Fastrack are Timex (I) → Probable conclusion → Some Timex can be Titan (I). Hence conclusion III follows.

अ, आ, इ, ऊआदि क्या हैं

'वह खाना खाकर सो गया।' इस वाक्य में कौन-सी क्रिया है?

'पाण्डु' शब्द विशेषण की दृष्टि से है-

'वियोग' का विपरीत शब्द है-

निम्नलिखित प्रश्न में , चार विकल्पों में से , उस विकल्प का �...

सक्रिय व्यक्ति जीवन में नाम कमाता है परन्तु…………..असफल ...

जब व्यक्ति स्वयं कार्य न करके किसी को कार्य करने के लिए प्�...

निम्नलिखित प्रश्न में चार-चार विकल्प दिए गए हैं, इनमें...

अशुद्ध वाक्य है-

निम्नलिखित वाक्य में निहित क्रिया का भेद पहचानिए—

अध्...