Question

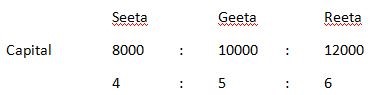

Seeta, Geeta and Reeta invested Rs. 8000, Rs. 10000 and

Rs. 12000 respectively. Partnership condition is that, each will get interest on his capital at the rate of 15% per annum and the remaining profit will be divided in the ratio of their capitals. If at the end of the year the total profit is Rs. 5925, then find the share of Reeta on profit?Solution

Interest for Seeta = (8000×15×1)/100 = 1200 Interest for Geeta = (10000×15×1)/100 = 1500 Interest for Reeta = (12000×15×1)/100 = 1800 Total interest of (Seeta + Geeta + Reeta) = (1200+1500+1800) = 4500 Remaining profit = (5925-4500) = 1425  According to the question, (4+5+6) units = 1425 15 units = 1425 1 unit = 95 Share of Reeta in remaining profit = 95 × 6 = 570 Total share of Reeta = 570+1800 = 2370

According to the question, (4+5+6) units = 1425 15 units = 1425 1 unit = 95 Share of Reeta in remaining profit = 95 × 6 = 570 Total share of Reeta = 570+1800 = 2370

Which two banks have received RBI approval to form Section 8 companies for the Indian Digital Payment Intelligence Corporation (IDPIC)?

Which of the following rivers has the largest river basin in India?

In June 2023, who became the first women player to win the ICC Player of the Month title for the 3rd time?

The ________ women’s team has won the ninth national women’s ice hockey championship organised by the Ice Hockey Association of India in Him...

What is the maximum loan amount available for systems between 3 kW and 10 kW under the Tata Power and Canara Bank partnership for rooftop solar installa...

What is the central theme of the Hindi film "IRAH"?

Which department launched the School Health Program in Uttar Pradesh and Lucknow Smart City?

By which year the target of Net Zero Emissions is set to end by India?

Which of the following statements is/are correct regarding Miyawaki Plantations?

i) It is a unique Japanese approach to ecological restoration an...

Which of the following country was not elected for the UN Human Rights Council for the 2022-24 term?

Relevant for Exams: