Question

Issue of securities, debt or equity, to a limited number

of subscribers, such as banks, FIs, MFs and high net worth individuals, is called?Solution

Private placement is issuance of securities, debt or equity, to a limited number of subscribers, such as banks, FIs, MFs and high net worth individuals. Private Placement is arranged through a merchant/investment banker, who brings together the issuer and the investor(s). As securities are allotted to a few investors and the general public does not have much stake in it, the securities offered in a private placement are exempt from the public disclosure regulations.

Who lives two floors above the floor on which S lives?

The number of persons sit between A and B is same as the number of persons sit between Q and ____?

How many persons were born between J and O?

How many persons stay between R and S?

Who among the following is wife of Prashant?

Priya is older than her cousin Manvi, Manvi's brother Bhaskar is older than Priya. When Manvi and Bhaskar are visiting Priya, all three like to play a g...

Which of the following statements is correct?

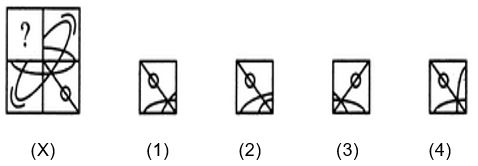

Identify the figure that completes the pattern.

On which floor does the person live who likes Shreya ghoshal?

Select the option that is related to the third term in the same way as the second term is related to the first term.

DFB : GHC :: LNJ : ?

Relevant for Exams: