Question

In April, RBI imposed a monetary penalty of Rs 36 lakh

on ____________ for non-compliance with certain directions of the central bank?Solution

RBI has imposed a monetary penalty of Rs 36 lakh on Central Bank of India for non-compliance with certain directions of the central bank. The order was issued on April 18, 2022. Central Bank of India has been penalised for failing to comply with directions issued by RBI on 'Customer Protection-Limiting Liability of Customers in Unauthorised Electronic Banking Transactions', RBI noted that the penalty has been imposed in exercise of powers vested in RBI under the provisions of section 47 A (1) (c) read with section 46 (4) (i) and section 51(1) of the Banking Regulation Act, 1949. RBI statutory Inspection for Supervisory Evaluation (lSE) of CBI was conducted by the RBI with reference to its financial position as of March 31, 2020.

Who lives two floors above the floor on which S lives?

The number of persons sit between A and B is same as the number of persons sit between Q and ____?

How many persons were born between J and O?

How many persons stay between R and S?

Who among the following is wife of Prashant?

Priya is older than her cousin Manvi, Manvi's brother Bhaskar is older than Priya. When Manvi and Bhaskar are visiting Priya, all three like to play a g...

Which of the following statements is correct?

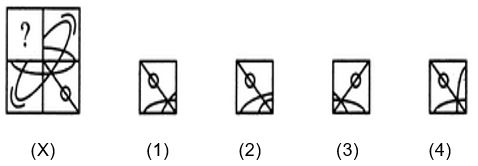

Identify the figure that completes the pattern.

On which floor does the person live who likes Shreya ghoshal?

Select the option that is related to the third term in the same way as the second term is related to the first term.

DFB : GHC :: LNJ : ?