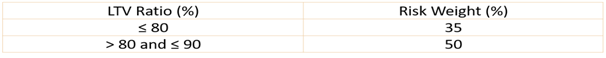

Question

What is the risk weight for the housing loans with LTV

Ratio (Loan to Value Ratio) lesser than 80%?Solution

In October 2020, the risk weights for all new housing loans from October 16, 2020 and up to March 31, 2022 were rationalized, as a countercyclical measure, irrespective of the amount of loan. These risk weights will continue for all new housing loans to be sanctioned up to March 31, 2023 as follows:  Loan to Value Ratio is the amount of loan that can be given as a percentage of the market value of a property, which is valued by an empaneled independent valuer identified by the Bank. For eg: if the market value of the property is 80 lakhs, then the maximum loan that can be given is (if LTV Ratio of the bank is 80%) 64 lakhs (80% of 80 lakhs). Other things like income of the applicant will also be considered to decide the final loan eligibility

Loan to Value Ratio is the amount of loan that can be given as a percentage of the market value of a property, which is valued by an empaneled independent valuer identified by the Bank. For eg: if the market value of the property is 80 lakhs, then the maximum loan that can be given is (if LTV Ratio of the bank is 80%) 64 lakhs (80% of 80 lakhs). Other things like income of the applicant will also be considered to decide the final loan eligibility

What is the atomic number of silicon, a component of quartz?

GIS stands for

Name the naval ship which is on its first ever Indian circumnavigation of the globe by an all-women crew:

Identify the rock that is not of igneous origin.

Who is the Minister of Education?

स्वेज नहर किस-किसको जोड़ती है ?

The 'Blue Revolution' is associated with the development of:

DICGC provides insurance to all kinds of bank deposits of upto Rs.1 lakh

Which Indian athlete won the gold medal at the Archery World Cup 2025 Stage 1?

Select the related word from the given alternatives.

Book : Read :: Knife : ?

Relevant for Exams: