Question

As per Section 182 of Companies Act 2013, a company,

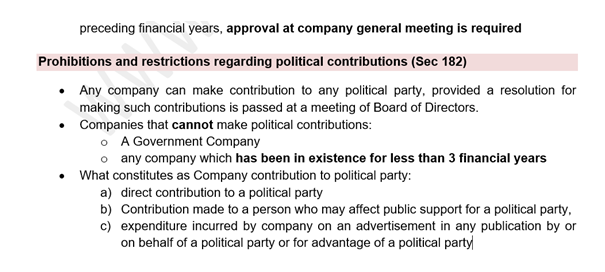

other than a Government company and a company which has been in existence for less than _____ financial year, may contribute any amount directly or indirectly to any political party.Solution

Section 182 – Prohibitions and restrictions regarding political contributions (1) Notwithstanding anything contained in any other provision of this Act, a company, other than a Government company and a company which has been in existence for less than three financial year, may contribute any amount directly or indirectly to any political party: Provided that no such contribution shall be made by a company unless a resolution authorising the making of such contribution is passed at a meeting of the Board of Directors and such resolution shall, subject to the other provisions of this section, be deemed to be justification in law for the making of the contribution authorised by it. Snapshot from study notes of the ixamBee SEBI course covering topic in crisp and easy to remember format Also same Question covered in revision Questions for Companies Act

Under Mission Vatsalya, the support is extended to which of the following Non-Institutional Care?

Which of the following institutions releases the Global Gender Gap Report?

Which of the following Statements regarding the coverage of NFSA is not True.

I- 75% of the rural population are covered under NFSA

I...

Which of the following is/are True?

I- The Asian Infrastructure Investment Bank (AIIB) is a multilateral development bank with a mission to im...

Which of the following is the third poorest state as per multidimensional poverty index?

Consider the following statement regarding Prime Minister’s Scholarship Scheme (PMSS):

I. PMSS is run by the Ministry of Home Affairs, Gove...

Which government agencies are collaborating in the implementation of the SVAMITVA Scheme?

Under the MSME credit enhancement scheme, the guarantee cover has been increased from ₹5 crore to—

Geographical indication (Registration and Protection) Act, ____________ provides legal protection to GIs holder in India.

Which of the following is NOT a feature of the Targeted Public Distribution System (TPDS) under the NFSA?