Question

What is the Additional Common Equity Tier 1

requirement as a percentage of Risk-Weighted Assets (RWAs) for SBI (as it’s a systemically important Bank)Solution

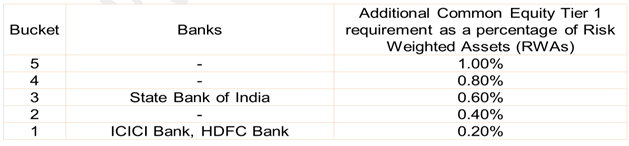

SBI, ICICI Bank, and HDFC Bank continue to be identified as Domestic Systemically Important Banks (D-SIBs), under the same bucketing structure as in the 2018 list of D-SIBs. The D-SIB framework requires the Reserve Bank to disclose the names of banks designated as D-SIBs starting from 2015 and place these banks in appropriate buckets depending upon their Systemic Importance Scores (SISs). Based on the bucket in which a D-SIB is placed, an additional common equity requirement has to be applied to it.

What happens to the wavelength of light when it passes from a medium of higher refractive index to a medium of lower refractive index?

Which of the following optical phenomena CANNOT convert unpolarised light to plane polarised light?

Which of the following quantities is a scalar?

Two cities are 125 km apart. Electric power is sent from one city to another city through copper wires. The fall of potential per km is 9.6 volt and the...

A light ray enters a glass slab from air at 60° incidence. If refractive index of glass is √3, what is angle of refraction?

A transformer works on which principle?

If a body of mass 5 kg is raised to 10 meters height, find its potential energy. (g = 9.8 m/s²)

A beam of light consisting of two wavelengths, 600 nm and 420 nm, is used to obtain interference fringes in a Young’s double-slit experiment. Find...

Calculate the kinetic energy of a body of mass 5 kg moving with a velocity of 4 m/s.

A dielectric placed between the plates of a capacitor increases its:

Relevant for Exams: