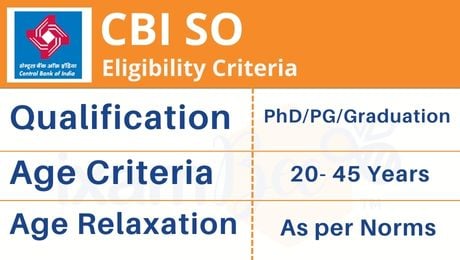

Central Bank Of India SO Eligibility Criteria 2026

Central Bank of India SO recruitment has specific criteria that are necessary to follow. The CBI SO eligibility criteria related to education, age, and other details of the Central Bank of India SO exam are mentioned below-

Central Bank Of India SO Educational Criteria (As on September 30, 2023)

Since the Central Bank of India SO official notification consists of different Specialist posts in various streams so a candidate must check his/her eligibility before applying so that the Central Bank of India SO online application form is not rejected. Besides this, a candidate needs to possess some years of experience for some posts, as mentioned in the Central Bank of India SO official notification 2026. In the case of dual specializations, one of the fields of specialization should be in the field mentioned. Candidates possessing an MBA degree with more than two specializations are not eligible. Detailed information is mentioned below-

| Post / Scale | Educational Qualification |

|---|---|

| Information Technology / AGM – Scale V | Full-time Master’s or Bachelor’s degree in Engineering disciplines like Computer Science/Information Technology/Electronics & Communication or Master’s in Computer Application with 60% marks or equivalent grade from a recognized University/Institute. |

| Risk Management/ AGM – Scale V | B.Sc in Statistics or Bachelor’s Degree in Analytical field (Statistics, Applied Maths, and Operation Research and Data Science) or MBA Finance or Banking with 55% marks from an AICTE/UGC approved University/College. |

| Risk Management/ CM – Scale IV | B.Sc in Statistics or Bachelor’s Degree in Analytical field (Statistics, Applied Maths, and Operation Research and Data Science) with 55% marks or MBA Finance or Banking with 55% marks from an AICTE/UGC approved University/College. |

| Information Technology / SM-Scale III | Engineering Graduate in Computer Science/IT/ECE with 60% marks or equivalent grade or MCA/M.Sc. (IT)/M.Sc. (Computer Science) with 60% marks from a recognized University/Institute. |

| Financial Analyst / SM – Scale III | Pass in the final examination of the Institute of Chartered Accountants of India (ICAI) or MBA with specialization in Finance with 60% marks. |

| Information Technology / Manager – Scale II | Engineering Graduate in Computer Science/IT/ECE with 60% marks or equivalent grade or MCA/M.Sc.(IT)/M.Sc. (Computer Science) with 60% marks. |

| Law Officer – Scale II | Bachelor Degree in Law (LLB) integrated 5 years/3 years regular course from a recognized University/Institute with 60% marks. |

| Credit Officer – Scale II | Graduate with Full-time MBA/MMS (Finance)/full-time PGDBM (Banking & Finance) with 60% Marks or a pass in the final examination of the Institute of Chartered Accountants of India (ICAI). |

| Financial Analyst/ Manager – Scale II | A pass in the final examination of the Institute of Chartered Accountants of India (ICAI) or MBA with specialization in Finance with 60% marks. |

| CA –Finance & Accounts/GST/Ind AS/Balance Sheet/Taxation – Scale II | A pass in the final examination of the Institute of Chartered Accountants of India (ICAI). |

| Information Technology / AM-Scale I | Engineering Graduate in Computer Science/IT/ECE with 60% marks or equivalent grade or MCA/M.Sc.(IT)/M.Sc. (Computer Science) with 60% marks. |

| Security/ AM – Scale 1 | Should be a Graduate. |

| Risk/ AM – Scale 1 | MBA/MMS/Post Graduate Diploma in Banking/Finance with aggregate of at least 60% marks from an Indian University/Institute recognized by Govt. Bodies/AICTE or Post Graduate in Statistics/Math with aggregate of at least 60% marks. |

| Librarian/ AM – Scale 1 | A degree (Graduation) in Library Science with 55% marks from a recognized university. |

Central Bank of India SO Work Experience

| Post / Scale | Experience |

|---|---|

| Information Technology / AGM – Scale V | Minimum 10 years’ post basic qualification experience in designing and launching digital products/platforms in BFSI Sector or Fintech companies. |

| Risk Management/ AGM – Scale V | Over all post basic qualification Banking experience of 10 years with a minimum of 6 years’ experience in Risk Management/Credit/Treasury/ALM in Scheduled Commercial Banks. |

| Risk Management/ CM – Scale IV | Over all post basic qualification Banking experience of 8 years with a minimum of 4 years’ experience in Risk Management/Credit/Treasury/ALM in Scheduled Commercial Banks. |

| Information Technology / SM-Scale III | Minimum 6 years of post basic qualification experience in SOC operations. |

| Financial Analyst / SM – Scale III | Minimum 1 year post qualification experience for CA/ICWA Candidates, and a minimum of 4 years’ post qualification experience as an officer in a PSB/Private Bank/PSU for MBA (Finance) candidates. |

| Information Technology / Manager – Scale II | Minimum 3 years of post basic qualification experience in SOC operations or IT, as per the role’s desirability. |

| Law Officer – Scale II | Enrolled as an advocate with Bar Council and 3 years’ experience of practice at Bar or Judicial service, and/or 2 years as a Law Officer in the Legal Department of a Scheduled Commercial Bank or the Central/State Government or of a Public Sector Undertaking. |

| Credit Officer – Scale II | Minimum 3 years’ post qualification experience as an officer in a PSB/Private Bank/PSU for MBA/MMS (Finance)/PGDBM (Banking & Finance) candidates. |

| Financial Analyst/ Manager – Scale II | Minimum 3 years’ post qualification experience for CA/ICWA candidates, and a minimum of 3 years’ post qualification experience as an officer in a Public Sector Bank/Private Bank/PSU for MBA (Finance) candidates. |

| CA –Finance & Accounts/GST/Ind AS/Balance Sheet/Taxation – Scale II | Desirable: Two years’ experience in relevant fields. |

| Information Technology / AM-Scale I | Minimum 1 year post qualification experience in IT sector/industry in the field of production deployment. |

| Security/ AM – Scale 1 | Ex-Junior Commissioned Officers with a minimum of 5 years’ service as JCO in the Indian Army or equivalent rank from Air Force, Navy, and Para Military Forces. |

| Risk/ AM – Scale 1 | Nil |

| Librarian/ AM – Scale 1 | Minimum 5 years’ post qualification experience. |

Please Note: In the case of Dual specializations, one of the fields of specialization should be in the field prescribed. In the case of Major/Minor specializations, major specialization should be in the field prescribed. Also, 59.99% will be treated as less than 60%. Therefore, apply for the CBI SO exam 2026 very carefully

Central Bank Of India SO Age Criteria (As on September 30, 2023)

A candidate should have attained a minimum age of 20 years and a maximum of 35 years as on September 30, 2023. While some posts have 40 and 45 years as the upper age limit. In general, age varies from one post to another. These age limits are for the general category. The candidate can refer to the table given below.

| Post / Scale | Age Criteria |

|---|---|

| Information Technology / AGM – Scale V | 45 Years |

| Risk Management/ AGM – Scale V | 45 Years |

| Risk Management/ CM – Scale IV | 40 Years |

| Information Technology / SM-Scale III | 35 Years |

| Financial Analyst / SM – Scale III | 35 Years |

| Information Technology / Manager – Scale II | 33 Years |

| Law Officer – Scale II | 33 Years |

| Credit Officer – Scale II | 33 Years |

| Financial Analyst/ Manager – Scale II | 33 Years |

| CA –Finance & Accounts/ GST/Ind AS/ Balance Sheet/Taxation – Scale II | 33 Years |

| Information Technology / AM-Scale I | 30 Years |

| Security/ AM – Scale 1 | 45 Years |

| Risk/ AM – Scale 1 | 30 Years |

| Librarian/ AM – Scale 1 | 30 Years |

Central Bank Of India SO Age Relaxation

Central Bank of India SO recruitment also provides age relaxation to reserved categories. The relaxation is on the upper age limit of the candidates. The relaxation years vary from one reserved category to another reserved category and a candidate should produce a valid document for claiming age relaxation when asked. The table provides the details for CBI SO age relaxation.

| Category | Age Relaxation |

|---|---|

| Other Backward classes (OBC) | 3 years |

| Scheduled Caste/Scheduled Tribe Candidates | 5 years |

| Children/Family members of those who died in the 1984 riots | 5 years |

Blog

- RBI Grade B Officer: Background Doesn’t Matter — Your Preparation Does

- How to Decide Which Government Exam You Should Prepare For?

- How to Prepare for the RBI Grade B 2025 Exam: A Comprehensive Guide

- Everything to know about RBI Grade B Previous Year Cutoffs

- Ace RBI Grade B 2024 Interview with Prachi Agarwal – Part 3