Question

Four of the following were in a certain group, which of

the following that does not belong to that group? Read the following information carefully and answer the questions given below. Eight members – M, N, O, P, Q, R, S and T of a family consists of three generations and were seated in a circular table facing centre, in which no three males were seated together. Each of them had a relationship with M. All of them attend the seminar in a different month from April to November. No two persons attend the seminar in the same month. It is further known that either both or none of the parents are alive. Two persons were seated between P and M’s father and neither of them attends the seminar in November. The one who was seated second to the left of P attend the seminar in May. Q is married to the only sister of the one who attends the seminar in June and was seated to the immediate left of M’s daughter. Two persons were seated between N and M’s wife. Only one female attend the seminar after June. Two persons were seated between M and the one who attend the seminar in September. S and her brother attend the seminar in consecutive months. Two persons attend the seminar between P and R. T attend the seminar in August. M and his father were immediate neighbours. O, who is the son of M was seated to the immediate right of his sister and attend the seminar after M but not immediately. The one who attends the seminar in September is nephew to P and both were seated adjacent to each other. Q is from 1st generation. P is not the brother of M’s wife. Two persons were seated between Q and the one, who attended the seminar June. The one, who attended the seminar in May doesn’t face the one, who attended the seminar June. O and P are not neighbours.Solution

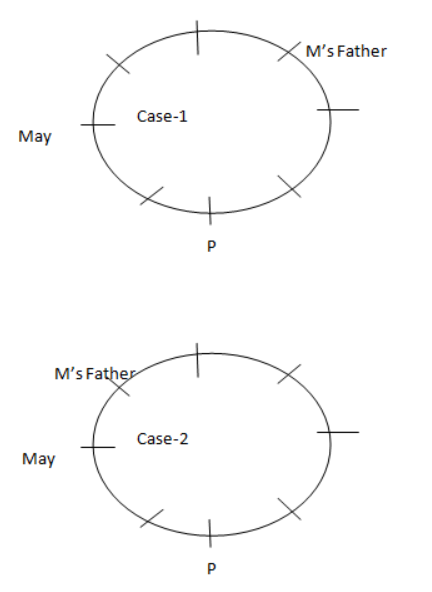

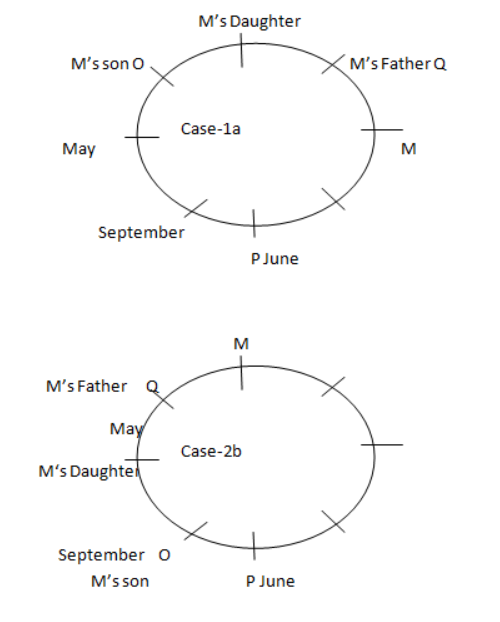

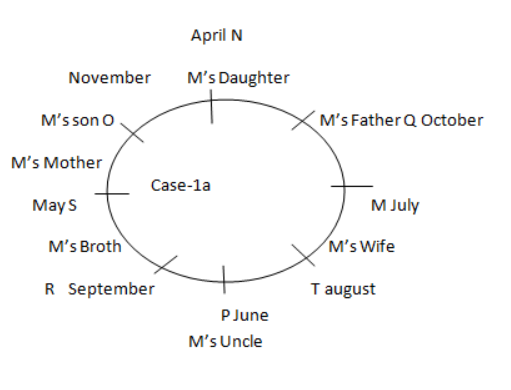

Two persons were seated between P and M’s father and neither of them attends the seminar in November. The one who was seated second to the left of P attend the seminar in May.  M and his father were immediate neighbours. Two persons were seated between M and the one who attend the seminar in September. The one who attends the seminar in September is nephew to P and both were seated adjacent to each other.

M and his father were immediate neighbours. Two persons were seated between M and the one who attend the seminar in September. The one who attends the seminar in September is nephew to P and both were seated adjacent to each other.

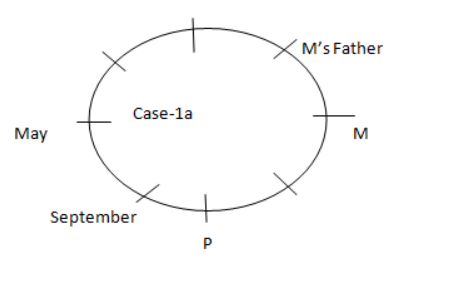

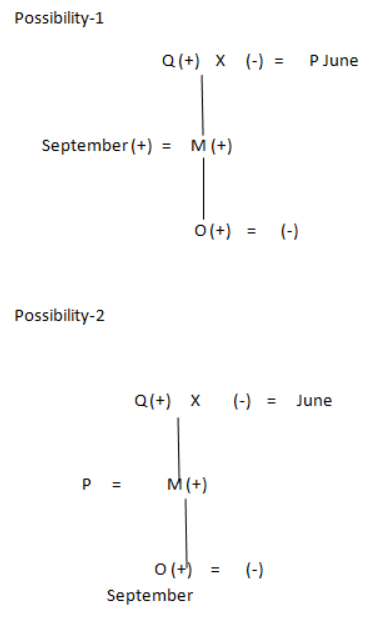

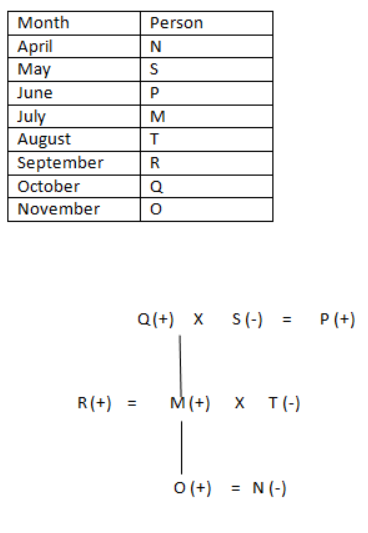

O, who is the son of M was seated to the immediate right of his sister and attend the seminar after M but not immediately. Q is married to the only sister of the one who attends the seminar in June and was seated to the immediate left of M’s daughter. Two persons were seated between N and M’s wife. Q is from 1st generation. P is not the brother of M’s wife. Two persons were seated between Q and the one, who attended the seminar June. The one, who attended the seminar in May doesn’t face the one, who attended the seminar June. O and P are not neighbours. Two possibilities in blood relation.

O, who is the son of M was seated to the immediate right of his sister and attend the seminar after M but not immediately. Q is married to the only sister of the one who attends the seminar in June and was seated to the immediate left of M’s daughter. Two persons were seated between N and M’s wife. Q is from 1st generation. P is not the brother of M’s wife. Two persons were seated between Q and the one, who attended the seminar June. The one, who attended the seminar in May doesn’t face the one, who attended the seminar June. O and P are not neighbours. Two possibilities in blood relation.

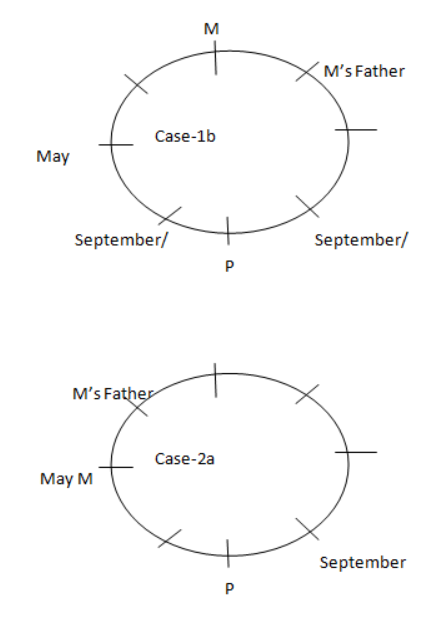

Hence, case 1b and case 2a are invalid because O was seated to the immediate right of M’s daughter and Q was seated to the immediate left of M’s daughter. Case 2b is invalid because P cannot attend the seminar in June (possibility 2 of blood relation diagram) So, possibility 2 of blood relation diagram is invalid.

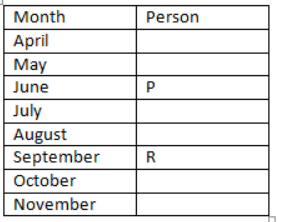

Hence, case 1b and case 2a are invalid because O was seated to the immediate right of M’s daughter and Q was seated to the immediate left of M’s daughter. Case 2b is invalid because P cannot attend the seminar in June (possibility 2 of blood relation diagram) So, possibility 2 of blood relation diagram is invalid.  Only one female attend the seminar after June. S and her brother attend the seminar on consecutive months. Two persons attend the seminar between P and R. T attend the seminar in August.

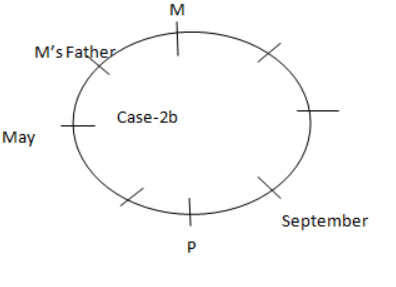

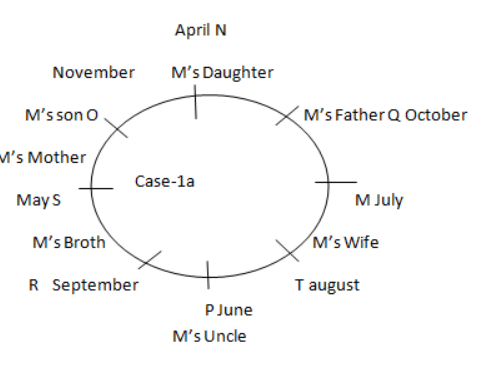

Only one female attend the seminar after June. S and her brother attend the seminar on consecutive months. Two persons attend the seminar between P and R. T attend the seminar in August.  So, the final solution is

So, the final solution is

Which of the following functions is used in C to initiate a DMA transfer when working with certain hardware libraries?

What is the term for the process of transferring data between physical memory and secondary storage in virtual memory systems?

Which logic gate produces an output that is the logical sum of two or more inputs?

How many labeled binary tress can be made with n nodes?

What is the primary purpose of virtual memory in a computer system?

Sending a packet to all destination simultaneously is called

Relational Algebra is

In a LAN, what is a common device used to connect multiple segments or networks and make forwarding decisions based on MAC addresses?

What is the correct way to declare a constant in C?

Performance of cache memory is frequently measured in terms of

Relevant for Exams: