Question

Who sits 2nd to the left of

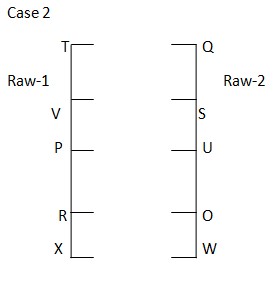

U? Answer the questions based on the information given below. Ten people O, P, Q, R, S, T, U, V, W and X are seated in two parallel rows such that five persons are seated in each row but not necessarily in the same order. Persons seated in row 1 are facing towards the east direction while persons seated in the row 2 are facing towards the west direction. Therefore, in the given seating arrangement persons seating in row 1 are facing and sitting opposite to the persons seating in row 2 and vice versa. X sits at one of the extreme ends and sits three places away from the one who faces S. P faces the one who sits to the immediate left of S. Only one person sits between P and T, who faces Q. U sits second to the left of Q and is sitting adjacent to the one who faces R. T is not sitting adjacent to R. Neither O nor V sits at the extreme ends. V neither faces west nor sits adjacent to U.Solution

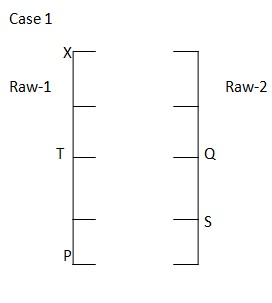

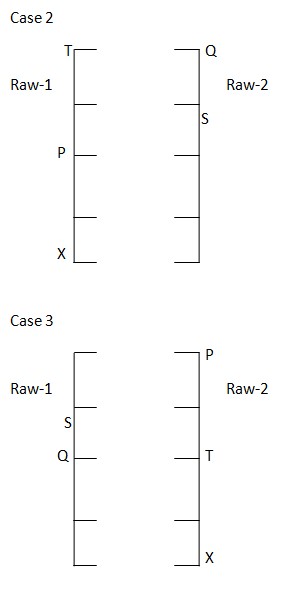

X sits at one of the extreme ends and sits three places away from the one who faces S.P faces the one who sits to the immediate left of S. Only one person sits between P and T, who faces Q. Now, as X either sits extreme right or left end of row 1 or sits extreme right or left end of row 2 so, we have four possible places for X.

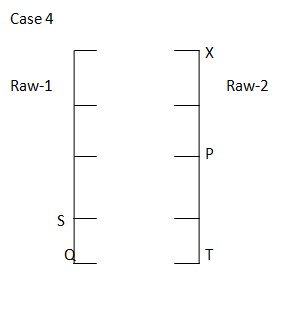

U sits second to the left of Q and is sitting adjacent to the one who faces R. T is not sitting adjacent to R. case I and III are invalid as R and T are not sitting together.

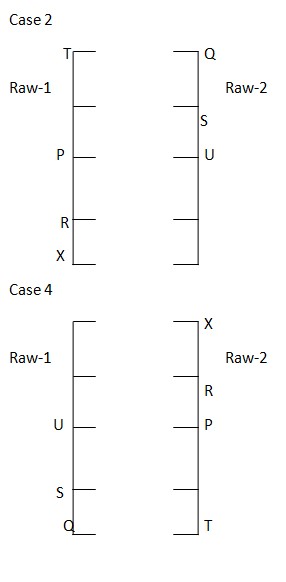

U sits second to the left of Q and is sitting adjacent to the one who faces R. T is not sitting adjacent to R. case I and III are invalid as R and T are not sitting together.  Neither O nor V sits at the extreme ends. V neither faces west nor sits adjacent to U. case IV is rejected as we can’t fix V in case IV. The final arrangement is as follows:

Neither O nor V sits at the extreme ends. V neither faces west nor sits adjacent to U. case IV is rejected as we can’t fix V in case IV. The final arrangement is as follows:

Which Indian leader died due to injuries sustained during the Anti-Simon Commission protests of 1928?

Who won the 2025 Ursula K. Le Guin Prize for Fiction?

In the context of the Bharat 6G Alliance and the Next G Alliance's collaboration, what is the primary focus of their Memorandum of Understanding (MoU)?

Against which team did Arshdeep Singh take his 100th wicket in T20Is, becoming the first Indian to achieve the feat?

NABARD's Rural Financial Inclusion Survey reported an increase in savings across households. What percentage of agricultural households reported having ...

Which organization developed the Indigenous Technologies of Thermal camera transferred to M/s Aditya Infotech (CP Plus)?

When is Vijay Diwas celebrated ?

How many Amrit Bharat stations are planned to be redeveloped by 2027 under the scheme?

Election Commission launched 'Mission-929' in which state?

Uttarakhand has become the first state in India to pass a Uniform Civil Code Bill after independence. Consider the following statements regarding this d...

Relevant for Exams: