Question

Who among the following sits immediate right of Q?

Study the following information carefully and answer the questions given below. Eight friends – M, N, O, P, Q, R, S, and T, are seating on nine seats in a straight line at an equal distance but not necessarily in the same order. One seat in the row is vacant. All of them are facing north directions. There are three persons sit between O and N. The person who sits two places away from N sits fourth to the right of M. M sits neither adjacent to O nor adjacent to S. The person who sits immediate left of the vacant seat sits two places away from O. Q does not sit adjacent to O. R sits two places away from Q. The number of persons who sits between N and R is one less than the number of persons who sits between S and Q. M does not sit at the end. T sits adjacent to N. The number of persons who sits between Q and P is same as the number of persons who sits between T and O. Q does not sit right of N.Solution

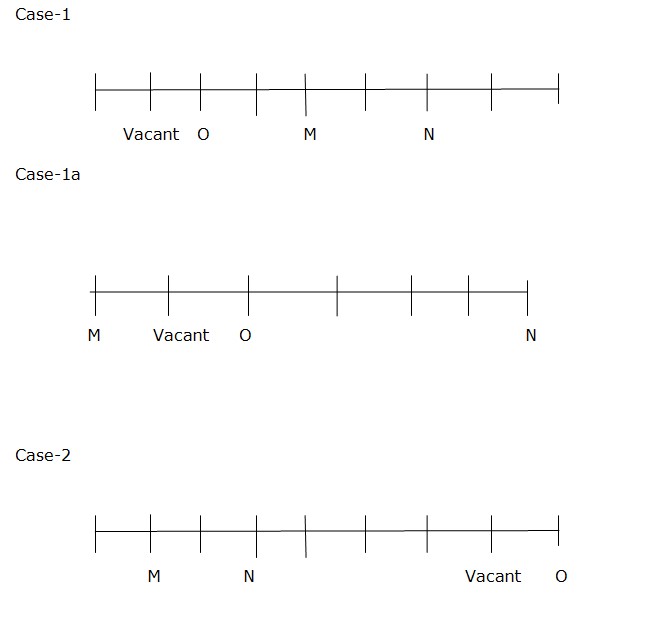

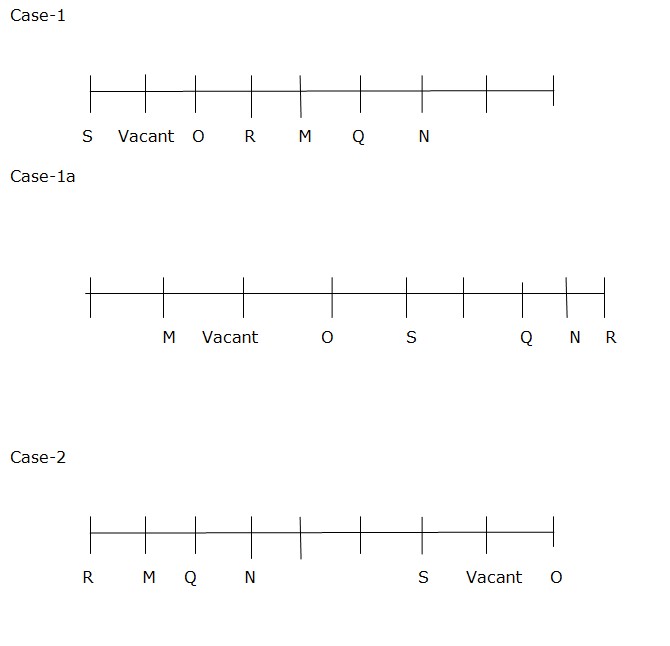

There are three persons sit between O and N. The person who sits two places away from N sits fourth to the right of M. M sits neither adjacent to O nor adjacent to S. The person who sits immediate left of the vacant seat sits two places away from O.  Q does not sit adjacent to O. R sits two places away from Q. The number of persons who sits between N and R is one less than the number of persons who sits between S and Q. M does not sit at the end. Q does not sits right of N.

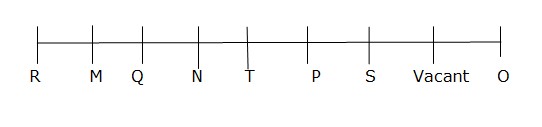

Q does not sit adjacent to O. R sits two places away from Q. The number of persons who sits between N and R is one less than the number of persons who sits between S and Q. M does not sit at the end. Q does not sits right of N.  T sits adjacent to N. This eliminates case 1a. The number of persons who sits between Q and P is same as the number of persons who sits between T and O. This eliminates case 1 and 1a. so final case-2 Case-2

T sits adjacent to N. This eliminates case 1a. The number of persons who sits between Q and P is same as the number of persons who sits between T and O. This eliminates case 1 and 1a. so final case-2 Case-2

When a manager takes inputs from his team members before taking a decision, he is referred to as ______

Rational decision making is a multi-step process starting with defining the problem. What is the next step in this process?

The Delphi technique of decision making was developed by _________

Which of the following technique of decision making is a process in which a group of individuals generate and state ideas, but in which the rules prohib...

Which of the following is the first step in decision making?

A plan that provides long-term, repetitive guidance for recurring activities and decisions within an organization is known as _____

Which of the following decision making style has low tolerance for ambiguity and is task oriented?

What is the purpose of evaluating the feasibility of possible solutions?

As per Mintzberg, a manager can perform 4 types of decisional roles. Which of the following is not one of them?

________ decision theory is concerned with how people actually make decision.

Relevant for Exams: