Question

Rs.5,000 is divided into two parts such that if one part

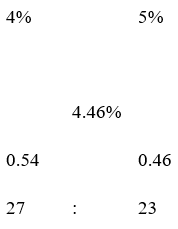

is invested at 4% and the other at 5%, then the whole annual interest from both sums is Rs.223. How much was invested in 4%?Solution

Rate of interest in total sum = (223/5000) ×100 =22300/5000=4.46%  Total sum =27+23=50 ATQ- 50=5000 1=100 Now the sum at the rate of 4%=27=2700

Total sum =27+23=50 ATQ- 50=5000 1=100 Now the sum at the rate of 4%=27=2700

What is the insurance cover provided under the 'Pradhan Mantri Garib Kalyan Package: Insurance Scheme for Health Workers Fighting COVID-19'?

International Financial Services Centres Authority (IFSCA) has signed a FinTech Co-operation Agreement (CA) with which of the following organisations to...

How much cash payment can be made to the beneficiary in India under MTSS?

The sum of all exposure of a FC-Finance Company/FU-Finance Unit in IFSC to a single counterparty or group of connected counterparties shall not exceed h...

Which of the following statement is correct:

1.A company's earnings being negatively affected by a strike by its workers or a major lawsuit again...

Section 45ZA in BANKING REGULATION ACT 1949 deals with?

Which of the following is an example of an offshore financial center?

Which process is being referred to in the above passage?

With respect to the Expenditure Budget, which of the following does not come under the Umbrella of Centers’ Expenditure there sub-classification?

What is the value of per unit of inventory if the firm uses absorption costing?

Direct material cost per unit = Rs.3

Direct Labour cost ...

Relevant for Exams: