Question

Two friends A and B started a business by investing

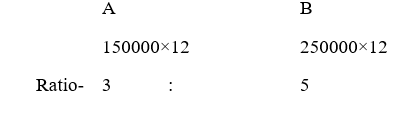

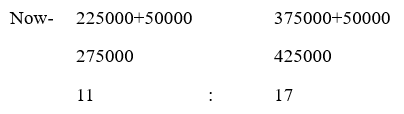

RS1,50,000 and RS 2,50,000, respectively. They agreed to distribute their earnings in the same ratio of their investments. After an year, the profit earned was RS 6,00,000. Each of them added RS 50,000 to their respective profits and invested in a different project. If this project gave an yield of RS 4,20,000, then A’s share in the profit is:Solution

Total =5+3=8 8 = 600000 1=75000 3= 75000×3=225000 5=75000×5=375000 Each of them 50000

Total =5+3=8 8 = 600000 1=75000 3= 75000×3=225000 5=75000×5=375000 Each of them 50000  28 = 420000 1= 15000 Profit part of A = 11×15000= 165000

28 = 420000 1= 15000 Profit part of A = 11×15000= 165000

Amit manages to reach 25% of a sales goal in 6 days, whereas Geeta can achieve 40% of the same goal within the same timeframe. How long would it take fo...

- A firm assigned 10 technicians to complete an assignment in 30 days. After 12 days of work, 4 technicians were moved to another location. What is the exten...

Ravi and Suresh can finish a task alone in 72 days and 96 days respectively. If both work together and earn Rs. 8,400 in total, how much does Ravi rece...

180 unit of work can be completed by P alone in 30 days. P started working alone and joined by Q after 18 days such that they completed the remaining wo...

- Rohit and Usha can complete a task individually in 24 days and 60 days, respectively. When they work together along with Vipul, the same task is finished i...

Raju and Raman can complete a piece of work in 12 days and 16 days, respectively. If they work on alternate days, starting with Raju, in how many days w...

A man, a woman, a boy, and a girl can complete a certain task individually in 84 days, 105 days, 140 days, and 210 days respectively. How long will it t...

P’s 3 days work is equal to Q’s 4 days work. If P and Q together can complete the work in 32 days then how much time Q will take to complete 75% of ...

P and Q together can finish a task in 72 days while Q and R can do it in 48 days. If P worked for 18 days, Q worked for 30 days, and then R finished the...

Ram can do a piece of work in 50 days. He alone worked at it for 20 days and then Lakshman completed alone the rest work in 30 days. In how many days, t...

Relevant for Exams: