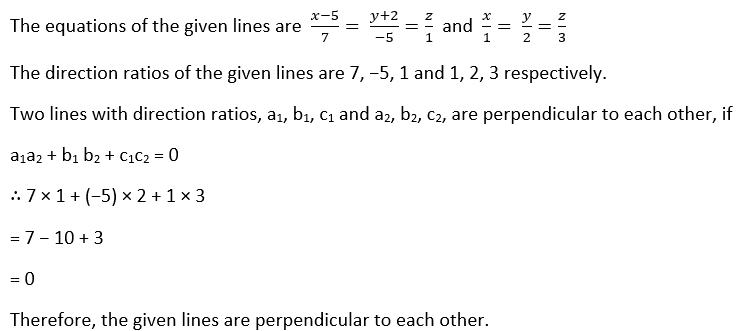

Question

src="https://www.ixambee.com/questionimage/AAI-JE-Air-Traffic-Controller/1658215321-AAIATCPartBMATHSMT2img035.png" alt="" />

Solution

More Lines and Angles Questions

'थाली' का तत्सम रूप है

'मारने को तत्पर होना' अर्थ के लिए सही मुहावरा कौनसा है?

अनुप्रास अलंकार का कौन - सा उदाहरण है ?

किस वाक्ये में भववाच्य का प्रयोग हुआ है ?

श, स, ष, ह किस प्रकार के व्यंजन है?

‘अखरोट‘ शब्द किस विदेशी भाषा से आया है ?

कृतज्ञ’ का विलोम क्या होगा :

जो सब-कुछ जानता हो’ के लिए एक शब्द है-

इत' प्रत्यय युक्त शब्द कौन-सा है ?

निम्नलिखित में कौन सा वाक्य शुद्ध है ?

Relevant for Exams: