Question

If Aman and Bhanu together earn

Rs. ___ per month, and their incomes increase by 25% and 12.5% respectively, Bhanu's new income becomes Rs. ___, which is 32% more than Aman's new income. Which of the following options can fill in the blanks? I. Rs. 14800, Rs. 9900 II. Rs. 11840, Rs. 7920 III. Rs. 9520, Rs. 6860 IV. Rs. 8880, Rs. 5940 V. None of theseSolution

ATQ, Increased Income of Bhanu = Rs.'b' Increased Income of Aman = Rs.b/1.32 Total Initial Income of Aman & Bhanu = b/(1.32 × 1.25) + b/1.125 = b/1.65 + b/1.125 = 20b/33 + 8b/9 = 148b/99 Option I, b = Rs.9900 Total Initial Income of Aman & Bhanu = 148/99 × 9900 = Rs.14800 Hence, Option I is correct. Option II, b = Rs.7920 Total Initial Income of Aman & Bhanu = 148/99 × 7920 = Rs.11840 Hence, Option II is correct. Option III, b = Rs.6860 Total Initial Income of Aman & Bhanu = 148/99 × 6860 = Rs.10255.35 Hence, Option III is incorrect. Option IV, b = Rs.5940 Total Initial Income of Aman & Bhanu = 148/99 × 5940 = Rs.8880 Hence, Only I, II and IV can fill the blanks

Who has written the novel ‘Ajay to Yogi Adityanath’?

Which one of the following is not an iron ore?

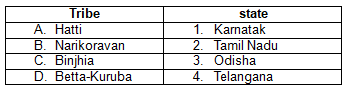

Consider the following pairs:

Which NBFCs are now allowed to co-lend with private lenders under RBI’s 2025 Co-Lending Arrangement reforms?

According to a joint report by India Cellular & Electronics Association (ICEA) and Accenture, what is the estimated revenue potential that circular busi...

Which tribal community celebrates the festival called Sohrai, derived from the paleolithic age word 'soro'?

In which year was Raj Bhavan established in Nainital?

Regarding the National Human Rights Commission (NHRC), consider the following statements:

1.The NHRC investigates complaints related to human rig...

India recently won the 2024 ICC T20 World Cup for the second time. In which year did India first win the ICC T20 World Cup?

'Mukhyamantri Ladli Behna Awas Yojana' has been launched in which state?

Relevant for Exams: