Question

When was the Reserve Bank of India

nationalized?Solution

The Reserve Bank of India was nationalized on January 1, 1949, transitioning from a privately-held institution to full government ownership. This strategic nationalization occurred shortly after India's independence and represented a critical component of the country's economic reforms. The nationalization ensured that monetary policy would be aligned with national interests rather than private sector priorities. Today, the RBI serves multiple crucial functions: formulating monetary policy, issuing currency, supervising financial institutions, maintaining financial stability, managing foreign exchange reserves, and acting as the lender of last resort during economic crises. The bank's transition to public ownership has enabled it to implement important initiatives including rural banking expansion and guided credit distribution in support of India's economic development objectives.

Who lives two floors above the floor on which S lives?

The number of persons sit between A and B is same as the number of persons sit between Q and ____?

How many persons were born between J and O?

How many persons stay between R and S?

Who among the following is wife of Prashant?

Priya is older than her cousin Manvi, Manvi's brother Bhaskar is older than Priya. When Manvi and Bhaskar are visiting Priya, all three like to play a g...

Which of the following statements is correct?

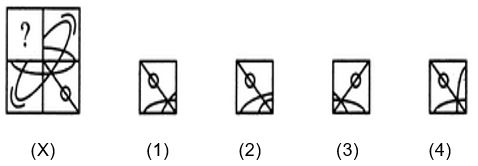

Identify the figure that completes the pattern.

On which floor does the person live who likes Shreya ghoshal?

Select the option that is related to the third term in the same way as the second term is related to the first term.

DFB : GHC :: LNJ : ?

Relevant for Exams: