Question

Solution

Naked or uncovered options are those which do not have offsetting positions, and therefore, are more risky. On the other hand, where the option writer has corresponding offsetting position in the asset underlying, the option is called covered option . Writing a simple uncovered (or naked) call option indicates toward exposure of the option writer to unlimited potential losses for earning more premium.

Who lives two floors above the floor on which S lives?

The number of persons sit between A and B is same as the number of persons sit between Q and ____?

How many persons were born between J and O?

How many persons stay between R and S?

Who among the following is wife of Prashant?

Priya is older than her cousin Manvi, Manvi's brother Bhaskar is older than Priya. When Manvi and Bhaskar are visiting Priya, all three like to play a g...

Which of the following statements is correct?

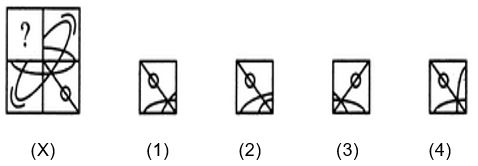

Identify the figure that completes the pattern.

On which floor does the person live who likes Shreya ghoshal?

Select the option that is related to the third term in the same way as the second term is related to the first term.

DFB : GHC :: LNJ : ?