Question

Which public sector bank of India becomes first public

sector bank to go live on Account Aggregator framework?Solution

The account aggregator (AA) facilitates sharing of financial information in a real-time and data-blind manner between regulated entities. UPI moment for lending, the AA framework ensures swift data sharing with the consent of the user and eliminates the need for physical documents. UPI moment for lending, the AA framework ensures swift data sharing with the consent of the user and eliminates the need for physical documents. The framework facilitates sharing of financial information on a real-time basis between regulated entities. AAs are licensed by the Reserve Bank of India to enable the flow of data between Financial Information Providers (FIPs) and Financial Information Users (FIUs). IPs are institutions that hold customer data and FIUs are entities that consume data to offer better service, underwrite loans, and so on. Banks and other financial institutions must become FIPs to be able to also become users of data from other financial institutions. Union Bank of India has said that it will work both as an FIU and FIP to allow its customers to share data digitally on a real-time basis. Major private sector banks like HDFC Bank, ICICI Bank, Axis Bank and Kotak Mahindra Bank are already live as FIPs and FIUs. There are 34 banks, non-banking financial companies (NBFCs) and other institutions so far live on AA, including Federal Bank, IDFC First Bank and IndusInd Bank.

(1748 ÷ 8) + 76.8 × 35 =(? × 4) + (42 × 35.5)

(560 ÷ 32) × (720 ÷ 48) = ?

What will come in the place of question mark (?) in the given expression?

642 - 362 = ? X √1225

- Calculate the value of x if x% of 400 plus {800 ÷ x of 8} × 4 is equal to 88

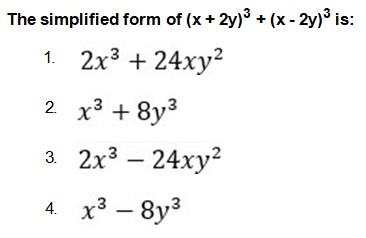

Simplify the following expression:

(3/5 of 250 + 40% of 150) ÷ (0.75 of 80)

Train M, ‘x’ metres long crosses (x – 30) metres long platform in 22 seconds while train N having the length (x + 30) metres crosses the same plat...

(92.03 + 117.98) ÷ 14.211 = 89.9 – 30.23% of ?

- What will come in place of (?), in the given expression.

(81 ÷ 9) + (121 ÷ 11) + (64 ÷ 8) = ?

Find the simplified value of the given expression:

7 of 9 ÷ 3 × 5² + √81 – 14

Relevant for Exams: