Question

What is the risk weight for the housing loans with LTV

Ratio (Loan to Value Ratio) lesser than 80%?Solution

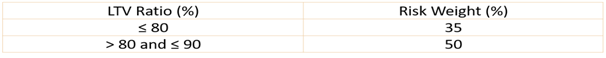

In October 2020, the risk weights for all new housing loans from October 16, 2020 and up to March 31, 2022 were rationalized, as a countercyclical measure, irrespective of the amount of loan. These risk weights will continue for all new housing loans to be sanctioned up to March 31, 2023 as follows:  Loan to Value Ratio is the amount of loan that can be given as a percentage of the market value of a property, which is valued by an empaneled independent valuer identified by the Bank. For eg: if the market value of the property is 80 lakhs, then the maximum loan that can be given is (if LTV Ratio of the bank is 80%) 64 lakhs (80% of 80 lakhs). Other things like income of the applicant will also be considered to decide the final loan eligibility

Loan to Value Ratio is the amount of loan that can be given as a percentage of the market value of a property, which is valued by an empaneled independent valuer identified by the Bank. For eg: if the market value of the property is 80 lakhs, then the maximum loan that can be given is (if LTV Ratio of the bank is 80%) 64 lakhs (80% of 80 lakhs). Other things like income of the applicant will also be considered to decide the final loan eligibility

Who has written the novel ‘Ajay to Yogi Adityanath’?

Which one of the following is not an iron ore?

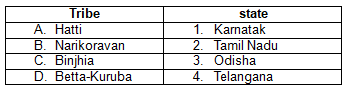

Consider the following pairs:

Which NBFCs are now allowed to co-lend with private lenders under RBI’s 2025 Co-Lending Arrangement reforms?

According to a joint report by India Cellular & Electronics Association (ICEA) and Accenture, what is the estimated revenue potential that circular busi...

Which tribal community celebrates the festival called Sohrai, derived from the paleolithic age word 'soro'?

In which year was Raj Bhavan established in Nainital?

Regarding the National Human Rights Commission (NHRC), consider the following statements:

1.The NHRC investigates complaints related to human rig...

India recently won the 2024 ICC T20 World Cup for the second time. In which year did India first win the ICC T20 World Cup?

'Mukhyamantri Ladli Behna Awas Yojana' has been launched in which state?

Relevant for Exams: