Question

A contract between two parties in which one party

purchases protection from another party against losses from the default of a borrower for a defined period of time is called:Solution

A credit default swap (CDS) is a contract between two parties in which one party purchases protection from another party against losses from the default of a borrower for a defined period of time. A CDS is written on the debt of a third party, called the reference entity, whose relevant debt is called the reference obligation, typically a senior unsecured bond. The two parties to the CDS are the credit protection buyer, who is said to be short the reference entity’s credit, and the credit protection seller, who is said to be long the reference entity’s credit. The CDS pays off upon occurrence of a credit event, which includes bankruptcy, failure to pay, and, in some countries, involuntary restructuring.

Which of the following option is incorrect about “Janani Suraksha Yojana”?

Which one of the following does not figure in the list of languages in the 8th schedule of the Constitution of India?

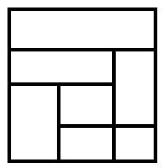

How many quadrilaterals are there in the given figure?

Which of the following statements is/are correct?

I. Jainism rose in popularity due to its simple doctrines and the use of a language understood ...

On the recommendation of which Commission, The payment of wages act 1936 Drafted?

Which of the following statements are correct about the “Lorenz Curve”?

I. The Lorenz curve is a graphic...

Among the four works mentioned below which one is encyclopaedic in nature?

Which one of the following facts pertaining to the National Green Tribunal (NGT) is not correct?

Article 243-I of the Constitution mandates setting up of the State Finance Commission (SFC) every _________ years.

The relationship between algae and fungi in Lichens is called as

Relevant for Exams: