Question

RBI has proposed to extend the BASEL-III Capital

regulations to All India Financial Institutions (AIFIs) and minimum total capital against risk-weighted requirements for the same is:Solution

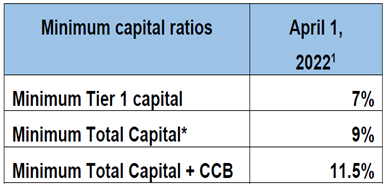

For NHB (National Housing Bank) Since the accounting year is July-June, the implementation shall commence on July 1, 2022. AIFIs are required to maintain a minimum Pillar 1 Capital to Risk-weighted Assets Ratio (CRAR) of 9% on an on-going basis (other than capital conservation buffer and countercyclical capital buffer etc.). These institutions should have minimum total capital at nine per cent from 1 April 2022 along with minimum capital buffer at 2.5 per cent, the central bank has recommended. Minimum common equity tier 1 (CET1) capital would be 5.5 per cent while minimum tier one capital requirement is proposed at seven per cent.

For NHB (National Housing Bank) Since the accounting year is July-June, the implementation shall commence on July 1, 2022. AIFIs are required to maintain a minimum Pillar 1 Capital to Risk-weighted Assets Ratio (CRAR) of 9% on an on-going basis (other than capital conservation buffer and countercyclical capital buffer etc.). These institutions should have minimum total capital at nine per cent from 1 April 2022 along with minimum capital buffer at 2.5 per cent, the central bank has recommended. Minimum common equity tier 1 (CET1) capital would be 5.5 per cent while minimum tier one capital requirement is proposed at seven per cent.

In the context of the C-PACE initiative launched by MCA, what does “A” stand for?

Until which year has SBI Life partnered with the Board of Control for Cricket in India (BCCI) as an official partner for the BCCI Domestic and Internati...

Consider the following statements regarding the Indian National Movement.

1. Romesh Chunder Dutt, a retired ICS officer, published ‘The Econ...

The ancient Harappan town of Lothal is situated in which state?

In the Australian Open 2022, which player emerged as the winner?

In which section of the Banking Regulation Act, 1949, is it stated that banks are not allowed to provide loans or advances to any of their directors?

How many squares are there on a chessboard ?

Which of the following trains of India is the fastest (as per trial runs), as of April 2022?

_____ was the son of a Chief of the Jnatrika (or Jhatrika) Kshatriya clan.

Each sentence below has one or two blanks. Fill in these blanks with the most appropriate word/ phrase from the four options that are given following ea...

Relevant for Exams: