Question

Special Situation Funds can be offered by registered

Fund Management Entity in IFSC, which of the following conditions govern them? (i) Only close ended SSFs are permissible, with minimum tenure of 3 years (ii) Extension of the tenure of the close ended special situation fund may be permitted up to five (5) years (iii) A special situation fund shall be constituted in IFSC as a company or LLP or Trust under the applicable laws of India.Solution

Ø SSFs can be launched by a registered FME Ø SSFs are permitted to acquire special situation assets, which includes: - Stressed loan available for acquisition - Security Receipts (SRs) issued by an Asset Reconstruction Company (ARC) registered with the RBI - Securities of investee companies (i) whose stressed loans are available for acquisition, (ii) against whose borrowings, SRs have been issued by an ARC, (iii) whose borrowings are subject to corporate insolvency resolution process, (iv) who has continuing default of loans, subject to conditions Ø Only close ended SSFs are permissible, with minimum tenure of 3 years Ø Extension of the tenure of the close ended special situation fund may be permitted up to two (2) years Ø subject to approval of two-thirds (2/3rd) of the investors by value: Ø Provided that any further extension beyond two (2) years may be considered subject to express consent of the investors and exit opportunity shall be provided to other investors. Ø Scheme corpus, eligible investors, investment conditions may be specified by the IFSCA Ø Leverage not permissible except to meet day to-day operational requirements Ø A special situation fund shall be constituted in IFSC as a company or LLP or Trust under the applicable laws of India.

Which of the following option is incorrect about “Janani Suraksha Yojana”?

Which one of the following does not figure in the list of languages in the 8th schedule of the Constitution of India?

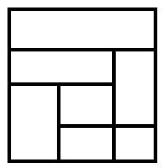

How many quadrilaterals are there in the given figure?

Which of the following statements is/are correct?

I. Jainism rose in popularity due to its simple doctrines and the use of a language understood ...

On the recommendation of which Commission, The payment of wages act 1936 Drafted?

Which of the following statements are correct about the “Lorenz Curve”?

I. The Lorenz curve is a graphic...

Among the four works mentioned below which one is encyclopaedic in nature?

Which one of the following facts pertaining to the National Green Tribunal (NGT) is not correct?

Article 243-I of the Constitution mandates setting up of the State Finance Commission (SFC) every _________ years.

The relationship between algae and fungi in Lichens is called as