Question

Customer pays 60% upfront, 20% on customization

completion (month 5), and 20% at end of PCS (month 24). Market borrowing rate for the customer is 10% p.a.; TechServe’s credit-adjusted rate is 11% p.a. Payment timing is a negotiated convenience for the customer. Does an Significant Financing Component (SFC) exist and which rate is appropriate?Solution

Front-loaded and back-ended payments over ~24 months create a financing benefit. Ind AS 115 requires adjusting for SFC using a rate reflecting the characteristics of the financing—typically the entity’s credit-adjusted rate at contract inception. The pattern here indicates a financing component, not merely alignment with transfer of goods/services.

Choose the figure that is different from the rest.

Choose one of the following correct combinations of mathematical signs which can be filled to balance the following equation.

Eight boys B1, B2, B3, B4, B5, B6, B7 and B8 are sitting in a row facing towards the north (not necessarily in the same order). B6 is fifth to the right...

Find the missing number in the following number series:

22.5, ____, 26.5, 30, 34.5

Based on the alphabetical order, three of the following four letter-clusters are alike in a certain way and thus form a group. Which letter-cluster does...

In a certain code language, 'FIVE' is written as '12184410' and FOUR is written as '12304236'. How will 'THREE' be written in that language?

Select the option that is related to the fifth letter-cluster in the same way as the fourth letter-cluster is related to the third letter-cluster and th...

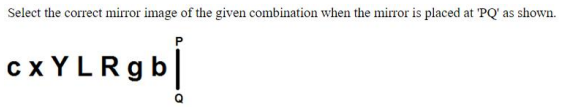

Select the correct mirror image of the given figure when the mirror is placed at MN.