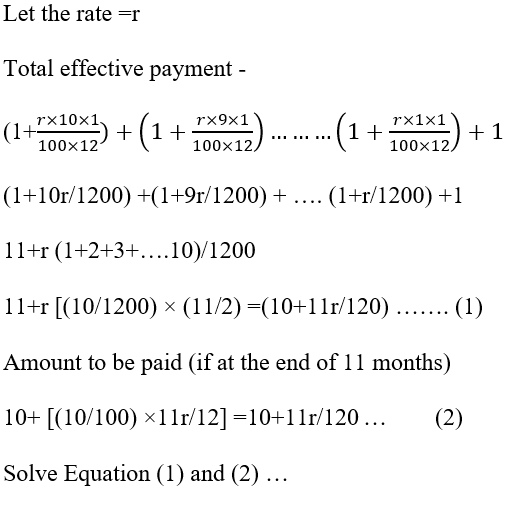

Question

A sum of Rs.10 is lent by a child to his friend to be

returned in 11 monthly instalments of Rs.1 each, the interest being simple. The rate of interest is: type-sscSolution

11+11r/240 =10+11r/120 (11r/120) -(11r/2400=1 11r =240 r = 240/11=21.8%

11+11r/240 =10+11r/120 (11r/120) -(11r/2400=1 11r =240 r = 240/11=21.8%

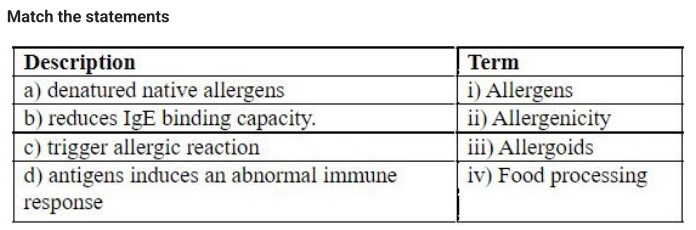

Match the following Bacterial genus with their respective groups A to D

1. Acetobacter Gluconobacter A. Butyrics

2. Lactobacillus streptoc...

Which macro nutrient plays major role in building muscle mass

Combination of two or more than that methods for synergistic preservation is called

Which electromagnetic rays are used to cook food in Microwave ovens?

Which of the following is an example of enzyme coagulated milk product?

a. Paneer

b. Dahl

c. Cheese

<...Propionic acid and its salts are used in ______ making.

Most UHT pasteurized milk has a shelf life of ___ days:

Bitterness in colocasia is due to:

The form in which Vitamin D occurs in foodof animal origin is called as:

Relevant for Exams: