Question

Consider the following statements about Indian

economy: 1. Share of Corporation tax is more than the share of Income Tax in Direct tax collected. 2. Average monthly gross GST collections have constantly increased since 2018. Which of the above statement/s is/are correct?Solution

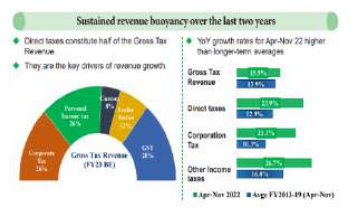

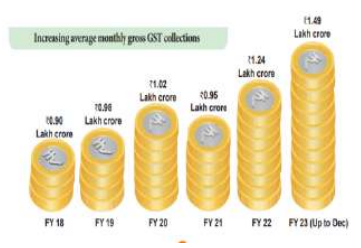

• Statement 1 is correct: The direct taxes, consisting mainly of corporate and personal income tax, constitute around 55 per cent of Gross tax revenue. The contribution of different taxes in GTR (FY23 BE) are:  • Statement 2 is Incorrect: GST collections have been a major source of revenue. They have been on the rise crossing 1.49 lakh cr in 2022 from 0.90 lakh cr in 2018. However, contrary to the trend year 2021 saw a dip in collections. This is better shown below:

• Statement 2 is Incorrect: GST collections have been a major source of revenue. They have been on the rise crossing 1.49 lakh cr in 2022 from 0.90 lakh cr in 2018. However, contrary to the trend year 2021 saw a dip in collections. This is better shown below:

Length and breadth of a rectangular field is (x + 7) cm and (x – 6) cm, respectively. If the cost of ploughing the field at a rate of Rs. 6 per cm² i...

The volume of cone is 1320 cm3. If its height is 1.4 cm then find the radius of the cone.

In an exam of 100 marks, the average marks of a class of 38 students are 72. If the top 3 scorers of the class leave, the average score falls “dow...

The circumference of a circle is equal to the perimeter of a rectangle whose length and breadth are in ratio 10:11, respectively. If the area of the rec...

The length of the rectangle is triple its breadth. If the perimeter of the rectangle is 40 m, then find the area (in m2) of the rectangle.

Total surface area of Cuboid is 1875 cm ² and the Sum of its Length, breadth and height is 45cm, and then find out the sum of the squares of its length...

The circumference of a semi-circle is 108 cm. What is the area of the circle with the same radius as the semi-circle? (Take π = 22/7)

Find the total surface area of a right circular cylinder with radius 7 cm and height 10 cm. (Take π = 22/7)

At the end of a business conference the ten people present all shake hands with each other once. How many handshakes will there be altogether?

A rectangular park is 30 m long and 20 m wide. A path of uniform width 2 m is built inside along its boundary. Find the area of the path.

Relevant for Exams: