Question

Consider the following statements about the

International Financial Service Centers Authority (IFSCA): 1. It is a unified authority for developing and regulating financial products, institutions and services in the IFSC in India. 2. It is headquartered at GIFT city, Gandhinagar, in Gujarat. 3. It assumed the power of RBI, SEBI, IRDAI and PFRDAI with respect to the development and regulation of IFSC in India. Which of the above statement is/are correct?Solution

As the dynamic nature of business in the IFSCs requires a high degree of inter-regulatory coordination within the financial sector, the IFSCA has been established as a unified regulator with a holistic vision to promote ease of business in IFSC and to provide a world-class regulatory environment. The International Financial Services Centres Authority (IFSCA) was established on April 27, 2020, under the International Financial Services Centres Authority Act 2019. It is headquartered at GIFT City, Gandhinagar, in Gujarat. From 1st October 2020, IFSCA assumed the power of four domestic sector regulators, namely the Reserve Bank of India (RBI), the Securities and Exchange Board of India (SEBI), Insurance Regulatory. 21 and Development Authority of India (IRDAI) & Pension Fund Regulatory and Development Authority of India (PFRDAI), in so far as the development and regulation of IFSCs in India were concerned.

(1748 ÷ 8) + 76.8 × 35 =(? × 4) + (42 × 35.5)

(560 ÷ 32) × (720 ÷ 48) = ?

What will come in the place of question mark (?) in the given expression?

642 - 362 = ? X √1225

- Calculate the value of x if x% of 400 plus {800 ÷ x of 8} × 4 is equal to 88

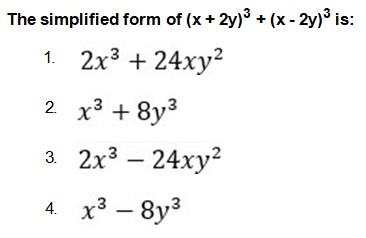

Simplify the following expression:

(3/5 of 250 + 40% of 150) ÷ (0.75 of 80)

Train M, ‘x’ metres long crosses (x – 30) metres long platform in 22 seconds while train N having the length (x + 30) metres crosses the same plat...

(92.03 + 117.98) ÷ 14.211 = 89.9 – 30.23% of ?

- What will come in place of (?), in the given expression.

(81 ÷ 9) + (121 ÷ 11) + (64 ÷ 8) = ?

Find the simplified value of the given expression:

7 of 9 ÷ 3 × 5² + √81 – 14