Question

What is the expected Common Equity Tier 1 (CET1) capital

improvement range for banks under the revised Basel III norms?Solution

According to IIFL Financials and other sources, the proposed cut in risk weights—especially for MSME and residential mortgage loans—is anticipated to lead to a 10–50 basis points (bps) improvement in CET1 capital for banks. This change enhances the capital position of banks and encourages more credit to key sectors.

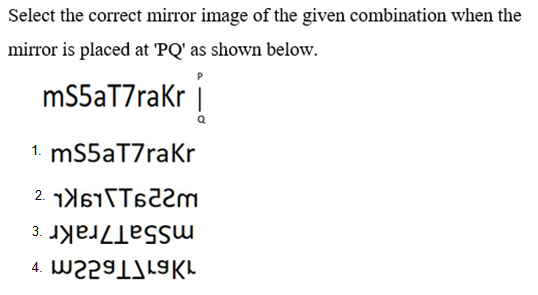

Select the correct mirror image of the given figure when the mirror is placed at MN as shown below.

Select the triad in which the numbers are related to each other in the same way as the numbers in the following triads.

8-17-35

23-47-95

Select the set in which the numbers are related in the same way as are the numbers of the following sets.

( NOTE : Operations should be perform...

Find the missing term in the following series.

AD25, CE64, EF121, GG196, ______

GPK : MSI : : RHT : VKT :: IDW : ?

Select the set of classes the relationship among which is best illustrated by the following Venn diagram.

Of the following two statements, both of which cannot be true, both can also be false. Which are these two statements?

I. All machines make noise...

'P + Q' means 'P is the daughter of Q'

'P × Q' means 'P is the son of Q'

'P – Q' means 'P is the wife of Q'

Which of the followi...

Select the option that represents the letters which, when sequentially placed from left to right in the blanks below, will complete the letter series.