Question

How much amount has been collected as tax deducted at

source on payments made from transfer of virtual digital currencies in March 2023?Solution

The government has collected Rs 157.9 crore as tax deducted at source on payments made from transfer of virtual digital currencies in March 2023. The government had brought virtual digital assets such as cryptocurrencies under the income tax net in the Union Budget 2022-23. Income from the transfer of these assets is taxed at the rate of 30%. Further, a 1% TDS is also levied on payment of transfer of these assets. Gift of VDAs is also to be taxed in the hands of the recipient.

Choose the figure that is different from the rest.

Choose one of the following correct combinations of mathematical signs which can be filled to balance the following equation.

Eight boys B1, B2, B3, B4, B5, B6, B7 and B8 are sitting in a row facing towards the north (not necessarily in the same order). B6 is fifth to the right...

Find the missing number in the following number series:

22.5, ____, 26.5, 30, 34.5

Based on the alphabetical order, three of the following four letter-clusters are alike in a certain way and thus form a group. Which letter-cluster does...

In a certain code language, 'FIVE' is written as '12184410' and FOUR is written as '12304236'. How will 'THREE' be written in that language?

Select the option that is related to the fifth letter-cluster in the same way as the fourth letter-cluster is related to the third letter-cluster and th...

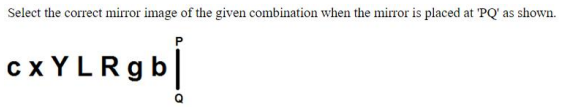

Select the correct mirror image of the given figure when the mirror is placed at MN.

Relevant for Exams: