Question

The RBI Monetary Policy Committee has now increased the

repo rate to _____ in October 2022.Solution

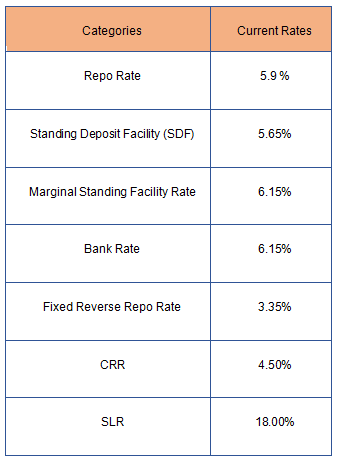

The RBI Monetary Policy Committee ( MPC) decided to hike the repo rate by 50 basis points. In the current financial year, the RBI has raised the repo rate by 190 bps. RBI will remain focused on withdrawal of accommodation after this revision too. The rates after revision are as follows- ( SASTRA) in 2005 including a cash prize of $10,000.  The MPC panel also cut its gross domestic product ( GDP) growth forecast for FY23 to 7% from 7. 2% , with Q2 at 6. 3% , Q3 at 4. 6% and Q4 at 4. 6%. Reserve Bank retained its inflation projection for current fiscal year at 6. 7 per cent amid global geopolitical developments triggered by the Russia- Ukraine war. For the September quarter of 2022- 23, RBI projected retail inflation at 7. 1 per cent. For third quarter, inflation is estimated at 6. 5 percent and further down to 5. 8 per cent in the March quarter. For first quarter of next fiscal year, retail inflation is projected at 5 percent.

The MPC panel also cut its gross domestic product ( GDP) growth forecast for FY23 to 7% from 7. 2% , with Q2 at 6. 3% , Q3 at 4. 6% and Q4 at 4. 6%. Reserve Bank retained its inflation projection for current fiscal year at 6. 7 per cent amid global geopolitical developments triggered by the Russia- Ukraine war. For the September quarter of 2022- 23, RBI projected retail inflation at 7. 1 per cent. For third quarter, inflation is estimated at 6. 5 percent and further down to 5. 8 per cent in the March quarter. For first quarter of next fiscal year, retail inflation is projected at 5 percent.

What is the height of Mount Everest that Kenton Cool summited?

Under the new ASCI influencer advertising guidelines, which professionals are required to disclose their certified expert status or practitioner credent...

PARVAZ Market Linkage Scheme has been launched by which state/UT?

Who is the winner of the 2022’s badminton tournament Super 750 held in Denmark?

Recently launched Mission LiFE ’ a mission related to?

Which year did the UN General Assembly establish the International Day of Peace?

What was the total amount pledged by international donors at the humanitarian conference for Sudan?

In which city is the G20 Film Festival being organized?

What was the cut-off rate set in the RBI’s latest Variable Rate Reverse Repo (VRRR) auction conducted in July 2025?

The Telangana government and UNESCO have entered into a collaboration to implement which recommendation focused on the ethics of Artificial Intelligence...

Relevant for Exams: