Question

The Basel III norms have prescribed a Leverage ratio of

a) ___% while the Reserve Bank of India has prescribed a leverage ratio of b)___% for D-SIBs and c)___% for other banks.Solution

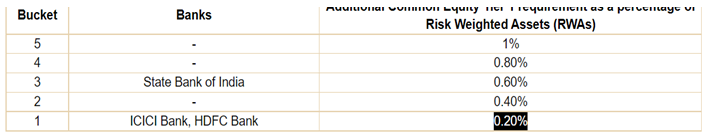

Some banks, due to their size, cross-jurisdictional activities, complexity, lack of substitutability and interconnectedness, become systemically important. The disorderly failure of these banks has the potential to cause significant disruption to the essential services they provide to the banking system, and in turn, to the overall economic activity. Therefore, the continued functioning of Systemically Important Banks (SIBs) is critical for the uninterrupted availability of essential banking services to the real economy. The D-SIB framework focuses on the impact that the distress or failure of banks will have on the domestic economy. As opposed to G-SIB framework, D-SIB framework is based on the assessment conducted by the national authorities, who are best placed to evaluate the impact of failure on the local financial system and the local economy. The additional Common Equity Tier 1 (CET1) requirement for D-SIBs was phased-in from April 1, 2016 and became fully effective from April 1, 2019. The additional CET1 requirement will be in addition to the capital conservation buffer. Based on data collected from banks as on March 31, 2017, HDFC Bank was also classified as a D-SIB, along with SBI and ICICI Bank.

The older Indian law governing civil aviation, which was recently replaced by the Bharatiya Vayuyan Adhiniyam, 2024, was enacted in which year?

The Muslim Women (Protection of Rights on Marriage) Act, 2019 deals with subsistence allowance in which of the following Sections?

Who among the following was the last Mauryan ruler and was killed by his commander-in-chief?

Which of the following is not present in Pteridophytes?

Which of the following five-year plan addressed the issue of removal of poverty as a chief objective for the first time?

What is the validity period for Kisan Credit Card?

In May 2021, the government had raised the FDI limit in the insurance sector to 74% from _________ .

The MSF rate is pegged _____ basis points or a percentage point above the repo rate?

Which Indian state is the largest producer of wheat?

With reference to the Green Revolution in India, what is the full form of HYVP?