Question

A firm observes that when it raises prices, competitors

do not follow, leading to a significant loss of customers, whereas when it reduces prices, competitors quickly match the price cut, resulting in little gain in market share. This pricing behavior gives rise to a discontinuous marginal revenue curve. In which type of market structure is this situation most likely to occur?Solution

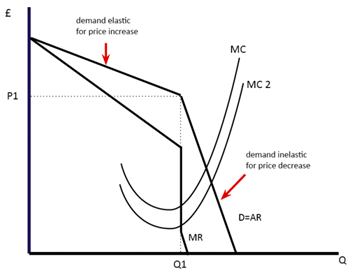

The scenario describes the kinked demand curve model, which arises in oligopolistic markets where firms are interdependent. A price increase is not followed by rivals, making demand highly elastic, while a price decrease is quickly matched, making demand inelastic. This creates a kink in the demand curve and a discontinuous marginal revenue curve, leading to price rigidity. The kinked demand curve is as below:  The logic of the kinked demand curve is based on

The logic of the kinked demand curve is based on

- A few firms dominate the industry

- Firms wish to maximise profits

- Perfect competition firms are price takers and do not face kinked demand.

- Monopolistic competition features differentiated products but lacks strong strategic price reactions.

- Monopoly faces a single downward-sloping demand curve without competitor reaction.

Index of Industrial Production is showing better performance after second wave, identify the base year of IIP ?

DuPont analysis is:

LIC Housing Finance entered into a strategic partnership for providing home loan products to over 4.5 crore customers of _____ bank?

Which organization unveiled SCORES 2.0 to enhance investor complaint redressal?

Calculate Debt Equity Ratio

I. Equity and Liabilities:

1. Shareholders’ funds

a) Share capital 4,00,000

b) Reserves a...

As per Union Budget 21-22, identify the budgetary allocation made for development finance institution?

What are the key services provided under PMJAY?

Which of the following country is not considered as the member of Dialogue Partners” of Shanghai Cooperation Organization?

SEBI has divided the Non-institutional Investors (NII) category into two based on the application size for book built IPOs. What proportion of NIIs has...

Which of the following leading NBFC has raised five-year loan of $100 million from the ADB through external commercial borrowing (ECB) under its social ...