Question

With reference to the Retail Participation in the

Capital Market, consider the following statements: 1. The share of individual investors in the cash segment marginally declined during FY23 (April-November 2022) compared to the same period during FY22. 2. The incremental additions of demat accounts have been on a declining trend during FY23 relative to FY22 3. The number of demat accounts rose sharply, 39% higher by the end of November 2022 on YoY basis. Which of the statements given above are correct?Solution

· The share of individual investors in the cash segment marginally declined during FY23 (April-November 2022) compared to the same period during FY22. Hence, statement 1 is correct. · However, the number of demat accounts rose sharply, 39% higher by the end of November 2022 on YoY basis. Hence, statement 3 is correct. · However, the incremental additions of demat accounts have been on a declining trend during FY23 relative to FY22, probably because of the increased volatility in the secondary market and subdued primary market performance, amid prevailing global headwinds during the current financial year. Hence, statement 2 is correct.

Who has written the novel ‘Ajay to Yogi Adityanath’?

Which one of the following is not an iron ore?

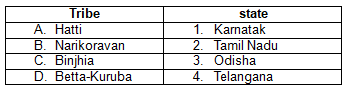

Consider the following pairs:

Which NBFCs are now allowed to co-lend with private lenders under RBI’s 2025 Co-Lending Arrangement reforms?

According to a joint report by India Cellular & Electronics Association (ICEA) and Accenture, what is the estimated revenue potential that circular busi...

Which tribal community celebrates the festival called Sohrai, derived from the paleolithic age word 'soro'?

In which year was Raj Bhavan established in Nainital?

Regarding the National Human Rights Commission (NHRC), consider the following statements:

1.The NHRC investigates complaints related to human rig...

India recently won the 2024 ICC T20 World Cup for the second time. In which year did India first win the ICC T20 World Cup?

'Mukhyamantri Ladli Behna Awas Yojana' has been launched in which state?