Question

When a commercial bank creates credit, its immediate

effect is that it raisesSolution

Extending credit or creating credit refers to one of the important functions of commercial banks that help in increasing money supply. For instance, a bank lends ₹ 5 lakh to an individual and opens a demand deposit in the name of that individual. Bank makes a credit entry of ₹5 lakh in that account. This leads to creation of demand deposits in that account. The point to be noted here is that there is no payment in cash. Thus, without printing additional money, the supply of money is increased.

Who has written the novel ‘Ajay to Yogi Adityanath’?

Which one of the following is not an iron ore?

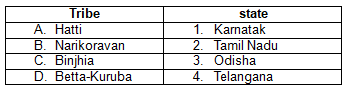

Consider the following pairs:

Which NBFCs are now allowed to co-lend with private lenders under RBI’s 2025 Co-Lending Arrangement reforms?

According to a joint report by India Cellular & Electronics Association (ICEA) and Accenture, what is the estimated revenue potential that circular busi...

Which tribal community celebrates the festival called Sohrai, derived from the paleolithic age word 'soro'?

In which year was Raj Bhavan established in Nainital?

Regarding the National Human Rights Commission (NHRC), consider the following statements:

1.The NHRC investigates complaints related to human rig...

India recently won the 2024 ICC T20 World Cup for the second time. In which year did India first win the ICC T20 World Cup?

'Mukhyamantri Ladli Behna Awas Yojana' has been launched in which state?

Relevant for Exams: