Question

When producer bears the cost of tax, what is the impact

on elasticity of demand and supply?Solution

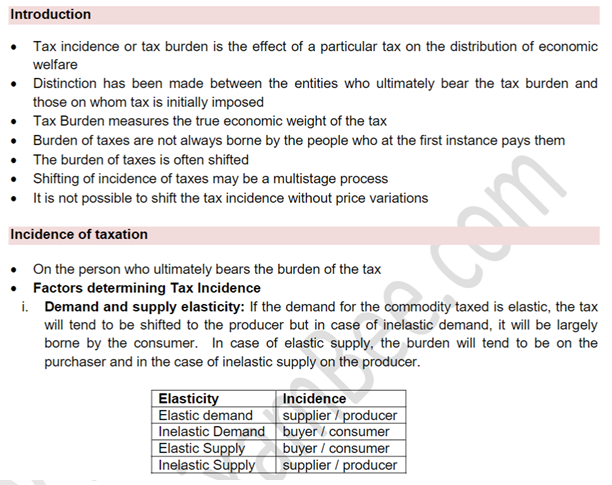

If the demand for the commodity taxed is elastic, the tax will tend to be shifted to the producer but in case of inelastic demand, it will be largely borne by the consumer. In case of elastic supply, the burden will tend to be on the purchaser and in the case of inelastic supply on the producer. Covered in videos and study notes; snapshot from study notes of the ixamBee SEBI course

Which of the following statement is incorrect?

Which one of the following is a deferred tax asset?

Which of the following statements are true or false?

Statement 1: Management of cash means management of cash inflow.

Statement 2: Cash ma...

Appointment of the first auditor of a government company shall be made by the ______ within ______ of registration of the company.

ABC Ltd. incurs direct material cost ₹8,00,000, direct labour ₹5,00,000, and factory overheads 60% of direct labour. Administration overheads are �...

Which of the followings is a valuation principal?

A Ltd owns land and building which are carried in its balance sheet at an aggregate carrying amount of 10 million. The fair value of such asset is 15 mi...

As per the Companies Act, 2013, the financial statements of a company include:

In relation to Accounting for Investments, which of the following statements is/are correct?

Statement-1: The carrying amount for long-term inves...

As per the Union Budget 2025–26, what is the target for the new Asset Monetization Plan for the period 2025–30?