Question

Small Finance banks need to maintain what percentage of

Capital adequacy ratio in order to meet one of the conditions to be eligible to get into Authorized Dealers-Category I for foreign exchange transactions as per the recent RBI CircularSolution

Eligibility norms for Small Finance Banks for Authorised Dealer Category-I

- The bank should have completed at least two years of operations as Authorised Dealer Category-II.

- The bank should have been included in the Second Schedule to RBI Act 1934.

- It should have a minimum net worth of ₹500 crore.

- Its CRAR should not be less than 15%.

- The net NPAs of the bank should not exceed 6%, during previous four quarters.

- It should have made profit in the preceding two years.

- It should not have defaulted in maintenance of CRR/ SLR during previous two years.

- It should have sound internal control systems.

- It should not have any major regulatory and supervisory concerns

Who has written the novel ‘Ajay to Yogi Adityanath’?

Which one of the following is not an iron ore?

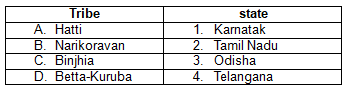

Consider the following pairs:

Which NBFCs are now allowed to co-lend with private lenders under RBI’s 2025 Co-Lending Arrangement reforms?

According to a joint report by India Cellular & Electronics Association (ICEA) and Accenture, what is the estimated revenue potential that circular busi...

Which tribal community celebrates the festival called Sohrai, derived from the paleolithic age word 'soro'?

In which year was Raj Bhavan established in Nainital?

Regarding the National Human Rights Commission (NHRC), consider the following statements:

1.The NHRC investigates complaints related to human rig...

India recently won the 2024 ICC T20 World Cup for the second time. In which year did India first win the ICC T20 World Cup?

'Mukhyamantri Ladli Behna Awas Yojana' has been launched in which state?