Question

Which of the following is incorrect in relation to

issuance of Bank Guarantee?Solution

Banks may issue guarantees favoring other banks/ FIs/ other lending agencies for the loans extended by the latter, subject to strict compliance with the following conditions. (i) The Board of Directors should reckon the integrity/ robustness of the bank’s risk management systems and, accordingly, put in place a well-laid out policy in this regard. The Board approved policy should, among others, address the following issues: Prudential limits, linked to bank’s Tier I capital, up to which guarantees favouring other banks/FIs/other lending agencies may be issued Nature and extent of security and margins Delegation of powers Reporting system Periodical reviews (ii) The guarantee shall be extended only in respect of borrower constituents and to enable them to avail of additional credit facility from other banks/FIs/lending agencies. (iii) The guaranteeing bank should assume a funded exposure of at least 10% of the exposure guaranteed. (iv) Banks should not extend guarantees or letters of comfort in favour of overseas lenders including those assignable to overseas lenders. However, AD banks may also be guided by the provisions contained in Notification No. FEMA 8/2000-RB dated May 3, 2000 and subsequent amendments thereof. (v) The guarantee issued by the bank will be an exposure on the borrowing entity on whose behalf the guarantee has been issued and will attract appropriate risk weight, as per the extant guidelines. (vi) Of late, certain banks have been issuing guarantees on behalf of corporate entities in respect of non-convertible debentures issued by such entities. It is clarified that the extant instructions apply only to loans and not to bonds or debt instruments. Guarantees by the banking system for a corporate bond or any debt instrument not only have significant systemic implications but also impede the development of a genuine corporate debt market. Banks are advised to strictly comply with the extant regulations and in particular, not to provide guarantees for issuance of bonds or debt instruments of any kind. However, banks are permitted to provide partial credit enhancement (PCE) to bonds issued by corporates /special purpose vehicles (SPVs), NBFC-ND-SIs and Housing Finance Companies (HFCs)

Who has written the novel ‘Ajay to Yogi Adityanath’?

Which one of the following is not an iron ore?

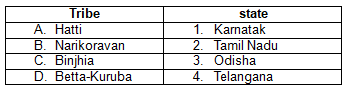

Consider the following pairs:

Which NBFCs are now allowed to co-lend with private lenders under RBI’s 2025 Co-Lending Arrangement reforms?

According to a joint report by India Cellular & Electronics Association (ICEA) and Accenture, what is the estimated revenue potential that circular busi...

Which tribal community celebrates the festival called Sohrai, derived from the paleolithic age word 'soro'?

In which year was Raj Bhavan established in Nainital?

Regarding the National Human Rights Commission (NHRC), consider the following statements:

1.The NHRC investigates complaints related to human rig...

India recently won the 2024 ICC T20 World Cup for the second time. In which year did India first win the ICC T20 World Cup?

'Mukhyamantri Ladli Behna Awas Yojana' has been launched in which state?

Relevant for Exams: