Question

The RBI has allowed international trade settlement in

rupees for which AD banks need to open ____________, in terms of Regulation 7(1) of Foreign Exchange Management (Deposit) Regulations, 2016.Solution

In order to promote growth of global trade with emphasis on exports from India and to support the increasing interest of global trading community in INR, RBI put in place an additional arrangement for invoicing, payment, and settlement of exports / imports in INR. Before putting in place this mechanism, AD banks shall require prior approval from the Foreign Exchange Department of Reserve Bank of India. In terms of Regulation 7(1) of Foreign Exchange Management (Deposit) Regulations, 2016, AD banks in India have been permitted to open Special Rupee Vostro Accounts. Accordingly, for settlement of trade transactions with any country, AD bank in India may open Special Rupee Vostro Accounts of correspondent bank/s of the partner trading country. The settlement through Indian Rupees (INR) is an additional arrangement to the existing system that uses freely convertible currencies and will work as a complimentary system. This will reduce dependence on hard (freely convertible) currency. Banks will need to take prior approval from RBI before opening a Special Rupee vostro account, unlike Rupee Vostro account.

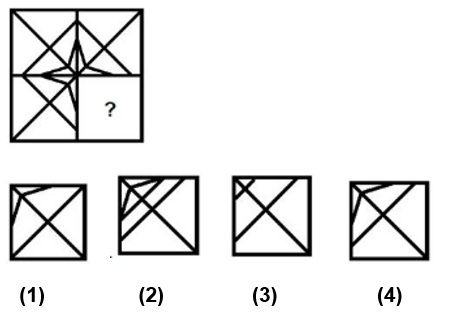

What will come in place of question mark(?)?

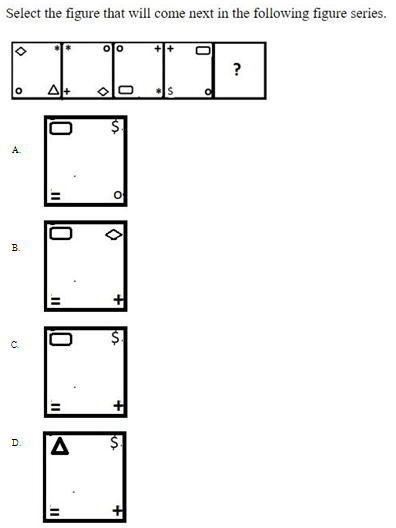

Select the figure that will come next in the following figure series.

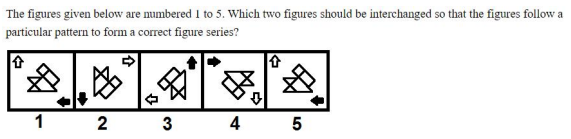

Identify the missing figure from the given options that completes the pattern.

Which of the given figures when placed in the 5th position would continue the series that is established by the first four figures?

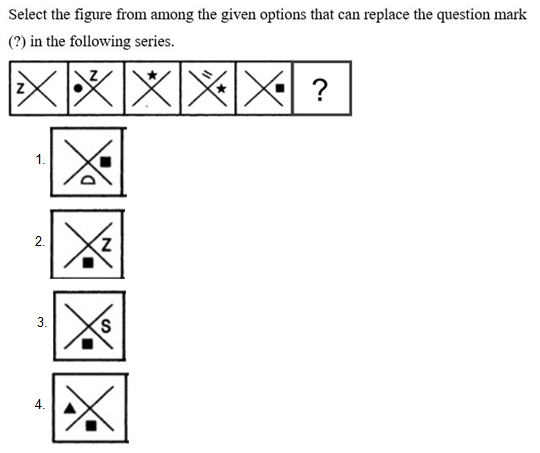

Select the figure from among the given options that can replace the question mark (?) in the following series.

Select an appropriate figure from the four options that will come next in the following figure.

Figure A is related to B following a certain pattern. Following the same pattern, figure C is related to D. Study the pattern and select the figure whic...

Relevant for Exams: