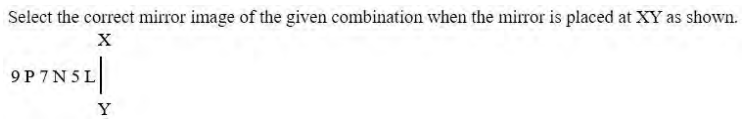

Question

How many stressed accounts have been identified for

transfer to NARCL (National Asset Reconstruction Company Limited) in a phased manner initiallySolution

National Asset Reconstruction Company Limited (NARCL) has received a license from the Reserve Bank of India (RBI), enabling it to start operations as a so-called bad bank, an entity formed to take over and dispose of the identified stressed assets worth Rs 2 lakh crore of commercial banks. IBA has been entrusted with setting up of the bad bank, for which the association has put in place a preliminary board. NARCL will acquire fully provisioned stressed assets by making an offer to the lead bank in a consortium of lenders; once the offer is accepted, NARCL will engage with India Debt Resolution Company Ltd. (IDRCL) for management and resolution of the stressed assets. NARCL will acquire stressed assets of about Rs 2 lakh crore in a phased manner. The stressed assets will be acquired through a 15 percent upfront cash payment and 85 percent in the form of security receipts. On September 16 2021, the cabinet cleared the proposal to provide a government guarantee worth Rs 30,600 crore to security receipts issued by NARCL. The difference between the face value of the stressed asset from the realised value from the sale or liquidation of assets represent the guarantee offered by the government. The guarantee will be valid for a period of five years. The transfer of 38 stressed accounts will happen in a phased manner, with banks agreeing to transfer 15 NPA accounts worth Rs 50,000 crore in the first phase by March 2022 (which could not be completed)

18 is related to 80 following a certain logic. Following the same logic, 23 is related to 100. To which ofthe following is 36 related, following the sam...

Eight people E, F, G, H, J, K, L and M are sitting around a circular table facing the centre but not necessarily in the same order. F is sitting second ...

Read the given statement and conclusions carefully. Decide which of the given conclusions logically follow(s) from the statement.

Statement:

Select the number from among the given options that can replace the question mark (?) in the following series. 85, 84, 92, 65, 129, ?

F is the brother of J. E is the sister of D. K is the sister of L. D is the son of L. J is the father of E. How is D related to F?

In a code language, tomato is called brinjal, brinjal is called radish, radish is called cabbage and cabbage is called okra. Which one of the following ...

In a certain code language, ‘RETAIL’ is written as ‘FNQWJY’ and ‘POLICE’ is written as ‘NHJUTQ’. How will ‘HARBOR’ be written in tha...

A man starts walking 10 meters east, then turns left and walks 5 meters. He then turns left again and walks 10 meters. He then again turns left and goes...

Seven people A, B, C, D, E, F and G are sitting around a circular table, facing the center (but not necessarily in the same order). C is sitting to the ...

Relevant for Exams: